FOREX.com Review 2024

KEY TAKEAWAYS

- FOREX.com is a good fit for scalpers, high-frequency, high-volume, and algorithmic traders.

- Multiple top-tier regulations exist, including CFTC in the US, FCA in the UK, and ASIC in Australia.

- Investor protection is £85k for UK clients, CAD 1 million for Canadian clients, and $0 for others.

- Select regulatory restrictions offer high leverage and fast order execution.

- The core MT4 and MT5 trading platforms are available, along with a cutting-edge proprietary trading platform.

- FOREX.com has a clean regulatory track record.

Best for:

| CFD trading | 90% |

| Low spread forex trading | 90% |

| Investing online | 85% |

| Founded | 1999 |

| Headquarters | United States |

| Products offered | Forex, CFD (index, stock, commodity, crypto) |

| Crypto | Ethereum, Bitcoin, Litecoin, Bitcoin Cash, Ripple |

| Account Type | Standard account, Commission account, Direct market access account |

| Deposit Options | Wire Transfer, Credit Card |

| Withdrawal Options | Wire Transfer, Credit Card |

| Available base currencies | EUR , USD, GBP, PLN, CHF |

| Number of currency pairs | 84 |

| Conversion fee of deposits in non-base currency | 0.5% charge |

| Deposit with bank card | Available |

| Deposit with electronic wallet | Available |

| Time to open an account | 1-3 days |

| Demo account provided | Yes |

| Trading Platforms | MT4, MT5, TradingView, eSignal, AutoChartist, TradingCentral |

| Regulations | CFTC US (United States), NFA US (United States) |

| Tier 1 Regulator(s)? | Yes |

| Owned by Public Company? | Yes |

| Execution Type(s) | Market Maker |

| Minimum Deposit | $100 |

| Max Leverage | Max. 1:50 (The maximum leverage can vary on your location, account type and volume of activity) |

| Negative Balance Protection | No |

| Islamic Account | Yes |

| Signals | Yes |

| Retail Loss Rate | 73.00% |

| Average Trading Cost EUR/USD | 1.1 pips |

| Average Trading Cost GBP/USD | 1.3 pips |

| Average Trading Cost WTI Crude Oil | $0.035 |

| Average Trading Cost Gold | $0.63 |

| Average Trading Cost Bitcoin | $60.00 |

| Minimum Raw Spreads | 0.0 pips |

| Minimum Standard Spreads | 1.2 pips |

| Minimum Commission for Forex | $7 per $100K |

| Deposit Fee | No |

| Withdrawal Fee | No |

| Inactivity Fee | $15 monthly after 12 months |

| MT4 | Yes |

| MT5 | Yes |

| MT4/MT5 Add-Ons | Yes |

| cTrader | No |

| Proprietary Platform | Yes |

| Automated Trading | Yes |

| Social/Copy Trading | Yes |

| DOM? | No |

| Guaranteed Stop Loss | No |

| Scalping | Yes |

| Hedging | Yes |

| One-Click Trading | Yes |

| OCO Orders | Yes |

| Interest on Margin | Yes |

| Customer Support Methods | Telephone, Email, LIve chat |

| Support Hours | 24/5 |

| Website Languages | English, Chinese |

FOREX.com’s Pros and Cons: FOREX.com Review

Pros

-

There is a great variety of currency pairs

-

There is a great variety of currency pairs

-

No withdrawal fee

-

Low stock index CFD fees

-

Trade over 80 currency pairs

Cons

-

Inactivity fee

-

High stock CFD fees

-

Only 600 instruments are available on FOREX.com’s MT4 platform, compared to over 5,500 on its non-MetaTrader platforms.

-

FOREX.com doesn’t produce video content as actively as peers in the research and education category, despite offering quality written content across both.

-

Desktop platform not user-friendly

FOREX.com: A Summary

FOREX.com is an online broker of investment and trading services established in 1999. It provides online tools and web and mobile platforms for users to easily trade, test, and analyze investment strategies.

It is a GAIN Capital brand under the parent company of StoneX Group (NASDAQ: SNEX), a Fortune 100 company and member of the National Futures Association (NFA) in the US. StoneX has assets worth $7.8 billion as of its latest annual report. By 2023, they employed more than 4,000 employees and served more than 400,000 retail customers in 180 countries.

About StoneX Group Inc.

StoneX Group Inc., a publicly traded company on NASDAQ with the symbol SNEX, advertises that it provides clients with global exposure to asset classes across asset classes through institutional-grade platforms, end-to-end clearing and execution, and high-touch expertise.” Connects to markets.

FOREX.com remains one of the largest retail forex brokers globally, with client assets in excess of $7.8 billion. According to the latest annual report, StoneX Group entities are projected to trade volumes of more than $4.4 trillion in 2023, making it the U.S. Becomes a leader in online forex trading.

Trading Hours At FOREX.com

At FOREX.com, FX trading is available 24 hours a day, from 22:00 GMT on Sunday to 22:00 GMT on Friday. However, it is worth noting that market hours at the beginning of the trading week often see illiquid conditions. As a result, the spread may increase.

Spot gold and silver market timings are slightly different. Trading is available 23 hours a day, from Sunday 23:00 GMT to Friday 22:00 GMT. Trading closes between 22:00 and 23:00 GMT each day.

During national holidays, trading hours may vary; for example, Christmas hours differ from standard hours. You can check the FOREX.com website for details. Make sure you check the local hours as per your geographical time zone.

Our Take on FOREX.com

FOREX.com is a trusted brand that provides an excellent trading experience for Forex and CFD traders around the world. The US-based company offers a wide range of transparent markets and limited access to MetaTrader, as well as an impressive suite of proprietary platforms. It offers everything you need for Forex trading: low Forex fees, multiple currency pairs, and lots of technical research tools.

Additionally, it lacks some popular asset classes, such as actual stocks or bonds. Stock CFD fees are high, and the desktop trading platform is not user-friendly.

Clients outside the US can trade currencies (80+ pairs), some stocks and ETFs, commodities, cryptocurrencies, and precious metals as CFDs. US clients can trade currencies and metals on the FOREX.com website and open separate accounts with the site’s owners, StoneX, to trade stocks and futures. FOREX.com’s services are best suited for high-volume currency traders.

Note: CFDs are banned in the US. If you are a US resident, you will not be able to trade CFDs on FOREX.com. US clients can trade currencies and metals on the FOREX.com website and open separate accounts with the site’s owners, StoneX, to trade stocks and futures.

Range of Investment Options Available

The products and services available to you on FOREX.com will depend on your location and which regulated entity holds your account.

On FOREX.com, you can trade:

- Indices: 15+ indices, including US 100, FTSE 100, and CAC 40

- Stock: 5,500+ popular stock CFDs, including Adidas, Tesla, Amazon, and Meta

- Forex: 80+ major, minor, and exotic currency pairs, including EUR/USD, GBP/USD, and EUR/GBP

- Commodities: 10+ spot and futures precious metals, energy, and agricultural products, including gold, crude oil, and coffee.

- Cryptocurrencies: Cryptocurrency trading is available via CFDs on FOREX.com, but not via trading the underlying asset (for example, buying Bitcoin).

Note: Crypto CFDs are available from any broker in the UK. The units are not available to retail traders or to the U.K. Available to residents (except professional clients).

Types of Accounts: FOREX.com Review

FOREX.com offers US traders three types of accounts. Although the platforms and prices differ depending on the type of account, they all use the same items.

Standard account

- The standard account is best for the average user and new foreign currency traders who seeking traditional spread pricing with no commissions. It has higher spread costs and no commissions.

- Traders who are prepared to pay more for the advantages of market-maker execution—a higher spread—will find favor with the Standard account.

- FOREX.com’s Standard account is the only option available for MetaTrader clients.

Commission account

High volume and seasoned traders are better off with the commission account. You receive reduced spreads with this account in exchange for a commission payment.

Direct market access account

The suggested minimum amount for this account is $25,000 for professional, high-volume traders. This offers pricing without any additional FOREX.com markup, straight from tier-one liquidity sources. After rebates, it offers smaller spreads and higher volume requirements for the lowest commissions.

Demo Account

FOREX.com offers two free demo accounts. A practice account and an MT4 demo account are available on the FOREX.com platform. Demo accounts are funded with $10,000 in virtual cash.

After you have your login credentials for your trial account, you can practice trading your preferred markets. Here, you can enjoy the following amenities:

- Simple and complex sequence types

- Actionable insights and analytics

- Account management from mobile and tablet apps

- Professional Charting: Clients can connect their accounts and trade from Trading View if it suits them.

It’s also easy to track your progress while also finding user guides and research to help you improve.

Once you become familiar with the markets and your confidence increases, you can close your demo account and upgrade to a live account.

How To Open A Demo Account

Opening a FOREX.com demo account is very simple:

- First, select ‘Try a Demo Account’ from the FOREX.com homepage.

- Next, add your name, email, country of residence, and contact number to the registration form, then press ‘Submit’.

- After which, the login credentials will be sent to your registered email address and displayed on the following screen.

- After this, you click on ‘Login Web Platform’.

- Choose between ‘Web Trading’ or ‘MetaTrader 4’ for testing.

FOREX.com’s Commissions and Fees: FOREX.com Review

FOREX.com is a bit expensive compared to the industry average in terms of commissions and fees, unless you are trading outside the US.

When signing up for your account, you have three cost structures:

- Commission-free trading costs listed on FOREX.com have a minimum of 0.3 pips, but the average spread is 1.2 pips, or $12.00 per standard lot.

- Commission-based accounts start with a minimum spread of 0.2 pips and a commission of $5.00 per round lot for a final cost of $7.00, which is reduced by a maximum of 15% to $6.25 through a five-tier active trader program.

- The DMA account features Forex spreads from 0.1 pips to a minimum commission of $6.00 for a final cost of $7.00, but this is reduced by 67% to $3.00 through the volume-based discount program.

Equity CFDs for US-listed assets cost a minimum of 0.08% per trade or $0.018 per share, which is 20% cheaper than most brokers.

The main thing at FOREX.com is that unless you trade more than $50 million per month, the total cost of the FOREX.com commission account remains practically the same as the standard account for US residents, except for execution. The method and available platforms vary.

Which price environment are forex traders supposed to choose?

I advise doing the following:

The commission-based pricing structure is more than 40% less expensive, while the commission-free trading account’s minimum deposit is the same.

DMA accounts have trading fees that are 75% less than those of the commission-free option, but they have a $100K minimum trade size, or roughly one typical Forex lot.

How to Open a FOREX.com Broker Account

Opening a FOREX.com account with a low minimum deposit is intuitive and completely digital. The account opening process takes about five minutes from start to finish if you have all your information readily available. On the other hand, account verification takes about 2 business days, which is not the fastest on the market. Additionally, if you don’t have everything you need, you can also save an application and continue it later.

- First of all, you have to go to FOREX.com and click on the button called “Open an Account”.

- On the next page, you have to choose the account type you want to open.

- Enter your details on the application form (country of residence, email, username, password, title, name, date of birth, and telephone contact number).

- Add your address, citizenship, and taxpayer information on the next page.

- The next section asks about your employment status, income, net worth, and trading experience.

- The final page requires acceptance of the FOREX.com Customer Agreement and offers to opt-in to the email list. Once you click Submit, your account is almost ready.

Once your account is processed and approved, which usually only takes a few minutes, you will receive an email with information on how to log in and deposit funds into your account.

Deposit and withdraw funds

FOREX.com provides multiple deposit and withdrawal options, all free of charge although third-party charges may apply. However, withdrawal is not possible with some credit cards.

How To Make A Deposit

You can fund your account quickly via the FOREX.com client portal. Simply select ‘Funding’ and then ‘Deposit’. Now just follow the on-screen instructions to complete the payment.

You can fund your account with:

- Neteller/Skrill: Immediate processing, maximum $50,000 funding, USD, EUR, and GBP currencies accepted

- Credit/Debit Card: Immediate processing, maximum $99,999 funding, USD, EUR, GBP, CAD, JPY, CHF, and AUD currencies accepted.

- Wire Transfer: Up to two-day processing time; no maximum funding limits. USD, EUR, GBP, CAD, JPY, CHF, and AUD currencies are accepted.

How To Make A Withdrawal

To make a withdrawal, visit the trading platform, then click “Add Funds.” Next, select the ‘Withdraw Funds’ menu item. The same method used to deposit the funds must be used to refund them.

- The minimum sum that can be withdrawn from FOREX.com is $100.

- Withdrawals made by bank transfer or debit card are capped at $25,000, while wire transfers are not limited.

- Transfers may take up to 48 hours to be processed, which is similar to most competitors.

One drawback is that wire withdrawals carry a fee of $25 up to $10,000. Debit card and bank transfer withdrawals are free of fees, so if you’re looking to cut expenses, I’d suggest using these.

Bonuses Paid by the FOREX.com Broker

FOREX.com offers a 20% welcome bonus up to $5000. To qualify for the bonus,

- You must deposit at least $250 and;

- Trade a minimum of 200 micro lots of currency pairs.

Note, that the bonus may not be available in some locations, including the United States, United Kingdom, Canada, or the People’s Republic of China.

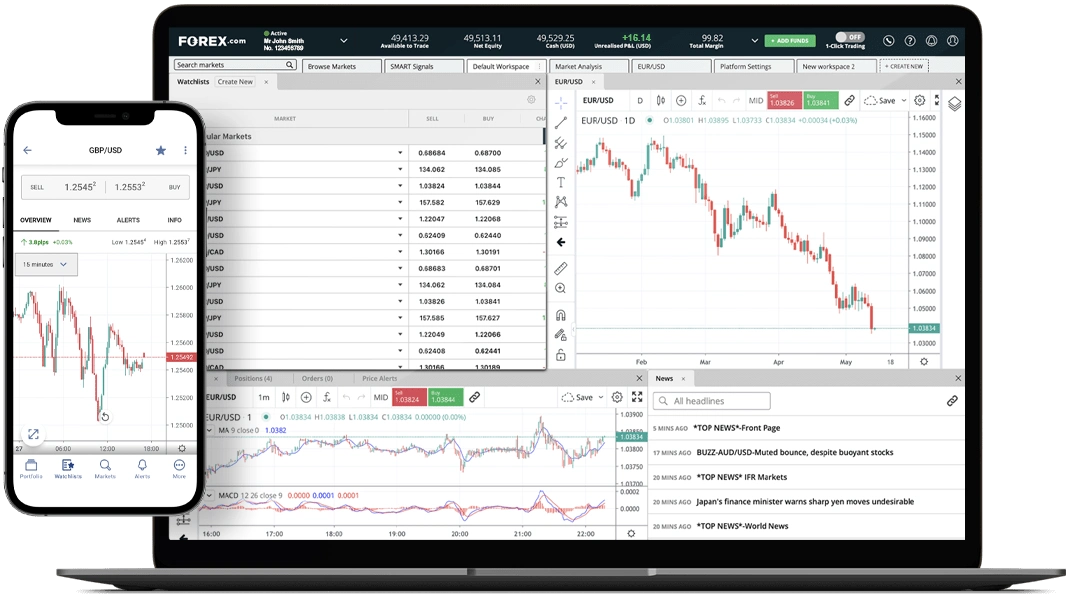

FOREX.com Platform and Technology: FOREX.com Review

FOREX.com offers different types of trading platforms including:

- Web Trader

- TradingView

- MetaTrader 4

- MetaTrader 5

- FOREX.com Mobile App

Web Trader

The web trading platform of FOREX.com is very configurable, easy to use, and offers a wide variety of order types. It is a good option if you are looking for a quick and easy-to-use platform.

It is compatible with most browsers and has a modern design with a clean interface. It is well-equipped for analysis, with 10 chart types and over 80 technical indicators.

TradingView

FOREX.com also provides access to TradingView. This is a fantastic substitute for complex visualization features and charting tools. It also offers a good degree of customizability.

Some of my favorite features include:

- Financial market screening to identify trading opportunities

- Dynamic alerts and notifications can be set for factors aside from price movements.

- Access to 80+ technical indicators and the option to create bespoke solutions using PineScript

- Access to a community forum designed to help find new ideas, get strategy feedback, and gain trading insights

MetaTrader 4

The MetaTrader 4 platform dominates the scene when it comes to FX and CFD trading. Its popularity is largely due to the range of in-depth trading tools, options for customization, and the fact that it is easy to navigate.

MetaTrader 5

FOREX.com also offers the latest software from MetaQuotes, MetaTrader 5 (MT5). MT5 offers more advanced tools and trading features for active users. This includes

- A wider range of analysis and drawing tools,

- Faster operations with a 64-bit, multi-threaded platform, plus EAs from FX Blue.

Ultimately, MetaTrader 5 is a better pick for high-volume day traders looking to run technical analysis and implement automated trading strategies. FOREX.com offers stock CFDs, index CFDs, commodity CFDs, and forex on the MT5 platform.

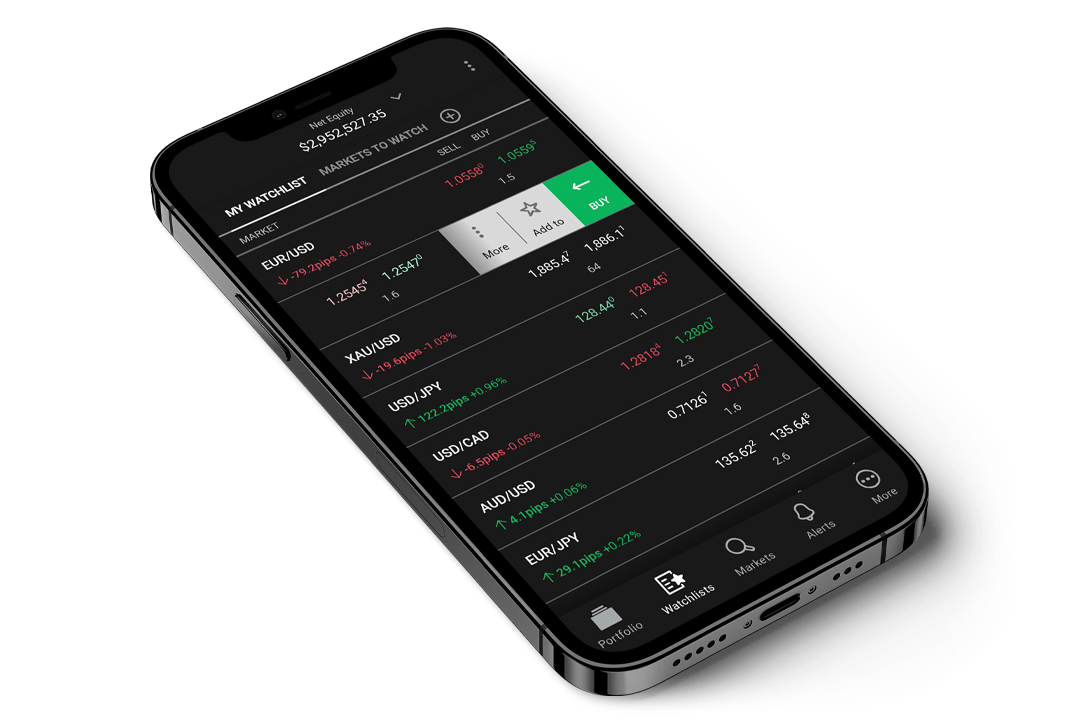

FOREX.com Mobile App Review

You can download FOREX.com’s apps for iOS and Android smartphones as soon as you register for an account.

Apps overview

- The mobile app for FOREX.com offers integrated trading tools, sophisticated charting, and full trading functionality. You can use integrated Reuters news, view an economic calendar, and set up alerts.

- There are 13 sketching tools and 26 indications in apps. Furthermore, it is simple and quick to navigate between live quotations, charts, and current positions.

- The most recent version of the program has “dynamic trade ticket,” which allows orders to be set by price, pips, and PnL, real-time risk management updates, and robust new charting—including templates—provided by TradingView.

Ease of use

- According to our testing, the FOREX.com mobile app is simple to use, trade, and manage positions. In this, we found that on the side of the app, you can get help through phone or live chat.

- Traders can easily view rates and market analysis and change their leverage from within the app. Deposits and withdrawals can also be made from within the application.

- The core of these apps gives traders equal access to a wide range of markets, so they can start trading oil or speculating on BTC or USD.

- There are also training videos within the application to help you get the most out of the platform.

FOREX.com Research and Education

Market research overview

- FOREX.com’s global research team provides all available resources along with its web trading platform, including multiple news channels, automated pattern recognition modules, and blog updates from Trading Central.

- There is also an integrated headlines stream from Reuters and a Trading Central-powered economic calendar across the site and platforms.

- Every day, FOREX.com generates a wide range of excellent written content on a number of markets and industry topics.

Education overview

The learning center provides in-depth educational material. Even the self-study course “Learn to Trade Forex” is available. Included in this seven-part course are:

- Pip calculators

- Trading on margin

- Advanced charting

- Establishing lot sizes

- Recognia (desktop only)

- Technical analysis & tools

- SMART signals that analyze thousands of data point daily

To assist you in managing risk and comprehending chart patterns, there are further interactive courses available, replete with instructional videos. Both beginners and seasoned traders can chart their education journey.

The ‘Foundations of Forex Trading’ webinar series is also available to traders; run in collaboration with Trade With Precision, traders can sign up for these directly.

The limited amount of video information in FOREX.com’s research offering is the only drawback, albeit it has become better every year.

FOREX.com Customer Service: FOREX.com Review

FOREX.com customer support is available 24 hours a day. You can contact the team via telephone, email, or live chat.

We rated the online chat function as best in class in our review and received a response from an agent in less than a minute.

The broker’s customer service team can assist with a range of issues, from minimum and maximum lot sizes to withdrawal problems and leverage calculators. Additionally, you can access support for general complaints, interest rates, opening hours, or web login issues.

You may find the extensive FAQ pages available on the FOREX.com website helpful. The section is organized into major categories, including managing your funds, opening an account, and trading with margin.

Security and Reliability of FOREX.com

The public firm GAIN Capital Holdings, headquartered in Bedminster, New Jersey, United States, owns FOREX.com. It reported assets and liquidity of $1.3 billion, far above regulatory capital requirements. It enforces strict account separation and security procedures.

The Cayman Islands Monetary Authority, as well as financial regulators in the UK, Japan, Canada, Australia, and the US, regulate its subsidiaries, which it operates around the world.

The higher level of regulation provides clear benefits to day traders. Most importantly, you can rest easy knowing that FOREX.com can be trusted.

Brokerages are regulated by:

| Country of the Regulator | United Kingdom, United States, Singapore, Australia, Canada, Japan, and the Cayman Islands |

| Name of the Regulator | ASIC, CFTC, CIMA, FCA, FSA, IIROC, NFA |

| Regulatory License Number | 0339826, Undisclosed, 446717, 400/21, 25033, 345646, Undisclosed, Undisclosed, Undisclosed |

It is also worth noting that the company is licensed and regulated in many other countries, so traders from Singapore, Vietnam, China, Indonesia, India, and many other countries are able to trade online with FOREX.com.

Final thoughts: FOREX.com Review

FOREX.com is a reliable forex broker that shines due to its comprehensive product offering, excellent platform options and selection of trading tools, and in-house and third-party market research.

The FOREX.com team has designed a platform suitable for any level of trading experience. Before opening a regular account, beginners should first sign up for a demo account. Intermediate to advanced users should consider commission and direct market accounts.

Furthermore, it is a great Forex and CFD broker that is regulated by several financial authorities, such as the UK FCA and the US CFTC. Positive aspects include a large number of tradeable currency pairings, cheap forex costs, and excellent research tools.

If you’re looking to delve into the world of forex, FOREX.com is a good starting point. Its user-friendly platform, extensive learning resources, and transparent nature make it a good choice to learn and trade. But with the advanced platform and account types, even the most experienced traders will probably be happy with the FOREX.com experience.

FAQs

Is FOREX.com good for beginners?

FOREX.com provides excellent market research, including ideas that can be traded, quality market research, ease of use across all its platforms, as well as an educational platform.

For example, its straightforward web platform offers a good variety of both basic and advanced features, including risk-management tools and robust charts, making it a good choice. As a result, it is considered one of the best brokers for novice traders.

Is FOREX.com free?

FOREX.com is not free. It also charges fees to its clients, as other brokers do.

- FOREX.com charges its clients fees in the form of commissions or spreads. They have both spread-only basic accounts and commission-based accounts available.

- There may also be fees associated with deposits or withdrawals, depending on the payment method you use.

- However, FOREX.com does not charge any costs on incoming deposits. Still, the method (i.e., sending a wire) may incur a fee from your bank.

FOREX.com Review Methodology

To compile broker reviews, we thoroughly investigate, verify, examine, and compare the elements that we consider the most important to consider when choosing any broker. It contains the benefits, drawbacks, and overall grades our research determines. We aim to help you find the ideal broker for your investor needs. You can read more about our review process by visiting this page.

68% of retail investor accounts lose money when trading CFDs with this provider. CFDs are complex instruments, with a high risk of losing money rapidly due to leverage. Consider whether you understand how CFDs work and can afford the high risk of losing your money.