OANDA Review 2024

KEY TAKEAWAYS

- The OANDA Trade mobile app has a great balance of features you’ll love.

- The range of tradable instruments for US clients is relatively small compared to what OANDA offers internationally.

- OANDA’s offering of research tools, news, and market analysis is excellent.

- Investor protection is £85k for UK clients, €20k for EU clients, CAD 1 million for Canadians, and $0 for other clients.

- Several top-tier regulators, including the FCA in the UK, CIRO in Canada, and ASIC in Australia

- OANDA Clean Track Record: No Major Regulatory Incidents or Fines

Best for:

| CFD trading with low spreads | 95% |

| Investing online | 90% |

| Great trading experience | 96% |

| Founded | 1996 |

| Headquarters | New York, United States |

| Trading Desk Type | Market Maker |

| Products offered | Stock, Forex, CFD, Crypto |

| Crypto | Bitcoin Cash, Bitcoin, Litecoin, Uniswap, Ethereum, Chainlink |

| Account Type | Standard, Core, Swap-free, Premium, Premium Core |

| Deposit Options | Credit and debit card, Bank wire and bank transfer, Skrill, Neteller |

| Withdrawal Options | Credit and debit card, Bank wire and bank transfer, Skrill, Neteller |

| Available base currencies | EUR, USD, GBP, AUD, CAD, CHF, HKD, JPY, SGD |

| Number of currency pairs | 68 |

| Conversion fee of deposits in non-base currency | 0.5% mark-up |

| Deposit with bank card | Available |

| Deposit with electronic wallet | Available |

| Time to open an account | 1-3 days |

| Demo account provided | Yes |

| Trading Platforms | OANDA Trade web platform, MetaTrader 4, TradingView, and the OANDA mobile app. |

| Regulators | ASIC, BVIFSC, CFTC, FCA, FSA, IIROC, MAS, MFSA |

| Tier 1 Regulator(s)? | Yes |

| Owned by Public Company? | No |

| Execution Type(s) | ECN/STP, Market Maker, Matched Principal Broker |

| Minimum Deposit | $0 (Standard); $10,000 (Premium) |

| Max Leverage | 1:200 |

| Negative Balance Protection | Yes |

| Islamic Account | Yes |

| Signals | Yes |

| Retail Loss Rate | 78.30% |

| US Person Accepted | Yes |

| Managed Accounts | No |

| Average Trading Cost EUR/USD | 0.9 pips |

| Average Trading Cost GBP/USD | 1.3 pips |

| Average Trading Cost WTI Crude Oil | $0.030 |

| Average Trading Cost Gold | $0.30 |

| Average Trading Cost Bitcoin | $62.00 |

| Minimum Raw Spreads | 0.0 pips |

| Minimum Standard Spreads | 0.6 pips |

| Minimum Commission for Forex | $5.00 per round lot |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

| Inactivity Fee | Yes ($10 monhtly after 12 months) |

| MT4 | Yes |

| MT5 | Yes, In some location |

| MT4/MT5 Add-Ons | Yes |

| cTrader | No |

| Proprietary Platform | Yes |

| Automated Trading | Yes |

| Social/Copy Trading | Yes |

| DOM? | Yes |

| Guaranteed Stop Loss | No |

| Scalping | Yes |

| Hedging | Yes |

| One-Click Trading | Yes |

| OCO Orders | No |

| Interest on Margin | No |

| Customer Support Methods | Email, Live Chat |

| Support Hours | 24/5 |

| Website Languages | English, Spanish, Chinese, French, Portuguese |

OANDA’s Pros and Cons

Pros

-

No minimum deposit and withdrawal

-

Great for beginner and expert traders

-

Great trading platforms

-

Outstanding research tools

-

Low forex and trading fees

Cons

-

Only FX and CFD are available for most clients (stocks only in the EU)

-

Offers fewer video market updates than its peers.

-

Customer support is not 24/7

-

Inactivity fee

OANDA: A Summary

The full form of OANDA is “Olsen & Associates” or “Olsen & Associates.” It was founded in 1996, is registered in the United States, and offers a wide range of financial services to its customers in most countries in the world.

OANDA Group is authorized to offer products to customers worldwide through several companies. It operates in eight global financial centers, serving clients in more than 196 countries through its entities licensed in six major regulatory jurisdictions, including the U.S., U.K., Canada, Australia, Japan, and Singapore.

Depending on where clients live, clients’ contracts with an OANDA subsidiary will vary. Because each subsidiary offers different products on different platforms, clients’ experiences with OANDA will vary depending on where they live.

Our Take on OANDA

OANDA is a trusted global brand with a clean regulatory record. It offers a high-quality and easy-to-use trading platform, and its research tools are also powerful, with multiple technical indicators and a great API offering. The account opening process is user-friendly and quick.

This is a good option for beginning investors. OANDA clients in the US can access several platforms: OANDA Web, MetaTrader 4, TradingView, and the OANDA Mobile App. However, OANDA’s limited range of tradable markets and below-average pricing keep it behind the best forex brokers.

Who OANDA Is for

We recommend OANDA for forex traders who value a user-friendly platform and great research tools. It can serve both experienced and inexperienced traders. Even beginners will find the OANDA web platform user-friendly and suitable.

To receive cash rebates, free wire transfers, and access to reputable third-party platforms, experienced traders in the US have the option to open an Elite Trader account.

OANDA recently rebranded its Advanced Trader program as Elite Trader, revising its perks and discount tiers for higher-volume traders (available exclusively in the U.S. and Canada).

Range of Investment Options Available

SUMMARY

OANDA Corporation which is the US unit of OANDA offers clients a range of forex pairs and spot cryptocurrencies. Traders can access major, minor, and exotic currency pairs as well as popular cryptocurrencies through a separate account.

The range of markets available at OANDA depends on which institution controls your account. U.S. CFDs are not available in the US, while in Australia and the British Virgin Islands, OANDA offers the option to trade 1744 symbols and 71 forex pairs, as well as Bitcoin, Ethereum, and Litecoin as CFDs.

I’ve summarized the available asset classes below:

- Bonds: Trade 6 government bonds, including the UK 10-year Gilt and US 5-year T-note

- Stocks: Over 1600 shares, including big US companies like Amazon, Tesla, Netflix, and Meta, plus 1,600+ individual stocks

- Indices: Speculate on 15 major global indices, including the FTSE100, S&P500, DE30, and ASX200.

- Forex: Trade 68 major, minor, and exotic currency pairs, including EUR/USD, USD/CAD, AUD/JPY, and GBP/USD.

- Commodities: Speculate on over 12 precious metals, energies, and soft commodities, including Brent crude oil, wheat, gold, and silver.

- Cryptocurrencies: 18 crypto tokens are available to trade against the USD, including Bitcoin, Ethereum, and Litecoin. OANDA’s partnership with Paxos provides access to spot crypto trading but does not allow crypto deposits or withdrawals.

- ETFs: A strong range of 41 share baskets are available, covering a range of sectors including technology, healthcare, and raw materials.

NOTE:

- CFD trading is not permitted in the United States due to Securities and Exchange Commission (SEC) restrictions on over-the-counter (OTC) instruments. OTC trading is done directly between two parties without any financial exchange.

- Certain OANDA entities provide crypto CFDs, but only in accordance with local laws; retail clients cannot purchase CFDs in the United States or the United Kingdom.

- Crypto CFDs are available from any broker in the UK. The units are not available to retail traders, nor to U.K. residents (except professional customers).

Types of Accounts

OANDA Corporation offers five different account types to cater to different trader profiles:

- Standard Account

- Premium

- Core

- Swap-free

- Premium Core

| Account Type | Description |

|---|---|

| Standard | ⚫ An account with a minimum deposit of $1. ⚫ Spread type: floating ⚫ The minimum spread for currency pairs is 1.1 pips. ⚫ The stop-out level is 50%. ⚫ Suitable for newcomers. |

| Premium | ⚫ An account with a minimum deposit of $20,000. ⚫ Spread type: floating ⚫ The minimum spread for currency pairs is 0.8 pips. ⚫The stop-out level is 50%. ⚫ Suitable for high-volume traders. |

| Core | ⚫ An account with a minimum deposit of $1. ⚫ Spread type: floating, ⚫ The minimum spread for currency pairs is 0.2 pips. ⚫ The stop-out level is 50%. ⚫ Suitable for newcomers. |

| Swap-free | ⚫ Spread type: floating, ⚫ The minimum spread for currency pairs is 1.6 pips. ⚫ The stop-out level is 50%. ⚫ Suitable for traders who do not wish to pay or receive interest on their accounts. |

| Premium Core | ⚫ An account with a minimum deposit of $20,000 ⚫ Spread type: floating, ⚫ The minimum spread for currency pairs is 0.2 pips. ⚫ The stop-out level is 50%.High-volume traders. |

Demo Account

OANDA offers free demo accounts, which are available on multiple platforms, such as MetaTrader 4, the OANDA Mobile App, and the OANDA Trade Web Platform. Beginners benefit greatly from demo accounts, as they can practice their techniques and become familiar with the trading platform without risking any real money.

Live quotations and real-time market conditions in several currency pairs are simulated by the demo account. Users can make changes to the live version immediately after getting up to speed on the sample account.

OANDA’s Commissions and Fees

Basically, while choosing a broker, you should be aware of the following various fees:

- Trading fees: These are the fees that users must pay when trading. The fees can come in various forms, such as commission, spread, or financing rate. The exact amount may vary for each broker.

- Non-Trading fees: These are the costs associated with the technical actions that users take in their accounts, like inactivity, withdrawal, and deposit fees.

OANDA’s Trading Fees

OANDA has two pricing options, namely spread-only and core pricing plus commission. This means you can choose to pay the spread with the spread-only option or get lower spreads with commissions with the core pricing plus commission model.

- Spread: With spread-only pricing OANDA charges you only the spread. The commission is included in the spread, so there will be no additional costs. Total prime pricing at OANDA starts as low as 0.0 for EUR/USD. For other Forex pairs, the minimum spread starts at 0.2 or higher.

- Core pricing plus commission model: The core pricing plus commission option offers access to a lower amount of spread, but you need to pay a fixed commission per trade. The commission is around $50 per 1M trade.

OANDA Non-Trading Fees

As mentioned above, non-trading fees are fees that are not related to buying and selling assets.

- Deposit Fees: OANDA charges zero fees for deposits for all payment methods, which means you don’t pay any fees for depositing funds to your trading account on OANDA, although your payment processor may charge you independent fees.

- Withdrawal Fees: OANDA charges withdrawal fees for bank transfers of $10 for your first transfer in a month, and subsequent transfers incur a cost of $20 per transaction. OANDA offers one free withdrawal via cards and PayPal, provided the PayPal account is denominated in GBP, EUR, or USD.

- Inactivity Fees: If you do not perform any trading activity on your account for 12 months, your account will be categorized as inactive, and any funds in it will be charged $10 each month.

| FEES | AMOUNT |

|---|---|

| Inactivity fee | $10 |

| Deposit fee | None |

| Withdrawal fee | None* |

*Your first withdrawal in a month is free. However, there is a fee for subsequent withdrawal. The fee depends on your account currency. This applies to credit/debit card and bank transfer transactions.

IG Review

IG Markets is a CFD and forex broker. It is not only a world-leading provider of trading and online execution platforms; it is also one of the most innovative companies in the industry, with a portfolio of unique trading products. READ MORE

How to Open an OANDA Broker Account

SUMMARY

The account opening process at OANDA Corporation is completely digital and can be completed in a short period of time through the company’s website.

To open a personal account at OANDA Corporation, potential clients must answer the following questions:.

- Go to the official website of OANDA and click on the “Start Trading” or “Create Account” tab at the top right of the screen.

- Next, choose your country of residence. OANDA needs to know your location, so choose your country and state.

- Fill in personal details: name, date of birth, mobile phone, citizenship, and residential address.

- Employment and financial details: company name, job title, industry, annual income, source of trading funds, personal net worth, liquid net worth.

- Trading Experience: Level of experience trading in futures, FX, securities, and cryptocurrencies. Whether you operate a commodity pool, a pooled investment vehicle, or act as an intermediary accepting funds from others, or if you will trade on behalf of others,.

- Verification of Identity: Fast Track method using driver’s license and SSN/TIN.

- Confirm your email address by clicking on the link sent to your inbox, which will log you into your trading account.

After uploading the relevant documents, it takes up to 24 hours for your account to be approved. Until your account is approved, you will be unable to deposit, withdraw, or trade funds.

Deposit and withdraw funds

SUMMARY

- Deposit: Credit and debit card, Bank wire and bank transfer, Skrill, Neteller

- Withdrawal: Credit and debit card, Bank wire and bank transfer, Skrill, Neteller

Processing times are relatively fast for the industry. Deposits are free, but there is a fee for withdrawals via bank transfer.

Adding money to and taking money out of your account is easy. OANDA charges no deposit or account fees. With a debit or credit card, you can make free withdrawals, however bank transfer withdrawals are very expensive.

How To Make A Deposit

Follow these simple steps to deposit money to your OANDA Account:

- Log in to your OANDA trading account via www.OANDA.com/account/login.

- Once your dashboard loads, click on the ‘Manage Funds’ tab.

- Select ‘Deposit’ and follow the on-screen instructions to add funds to your account.

How To Make A Withdrawal

You can withdraw any amount using any payment method on OANDA, and there is no mandatory minimum withdrawal amount. OANDA processes all withdrawal requests in a single business day; however, bank transfers may take up to five business days to complete and card payments may take up to three business days to process.

Follow these simple steps to withdraw money from your OANDA Account:

- Log in to your OANDA dashboard via www.OANDA.com/account/login.

- Once your dashboard loads, click on the ‘Manage Funds’ tab.

- Select ‘Withdraw’ and follow the on-screen instructions to withdraw funds from your account.

NOTE:

- If a credit card withdrawal is made more than once a month, the corporation will impose a commission of $15 or more.

- Typically, bank card withdrawals take three to seven working days. Bank transfers also take 3 to 7 business days. Withdrawal via the electronic payment system PayPal takes from 1 to 3 business days.

Bonuses Paid by the OANDA Broker

At the time of writing this review, Oanda does not offer any bonuses or promotions. Most of the regulatory jurisdictions prohibit them.

OANDA Platform and Technology

SUMMARY

OANDA is a standout in this category thanks to its extensive portfolio of third-party and proprietary platforms. The OANDA mobile app, MetaTrader 4, TradingView, and the OANDA Web platform are the options available to clients. My evaluation indicated that this variety of platforms can cater to beginners and advanced traders.

OANDA offers two platform suites; the popular MetaTrader 4 (MT4) platform, available for web and desktop, and OANDA’s Trade web and desktop trading platform.

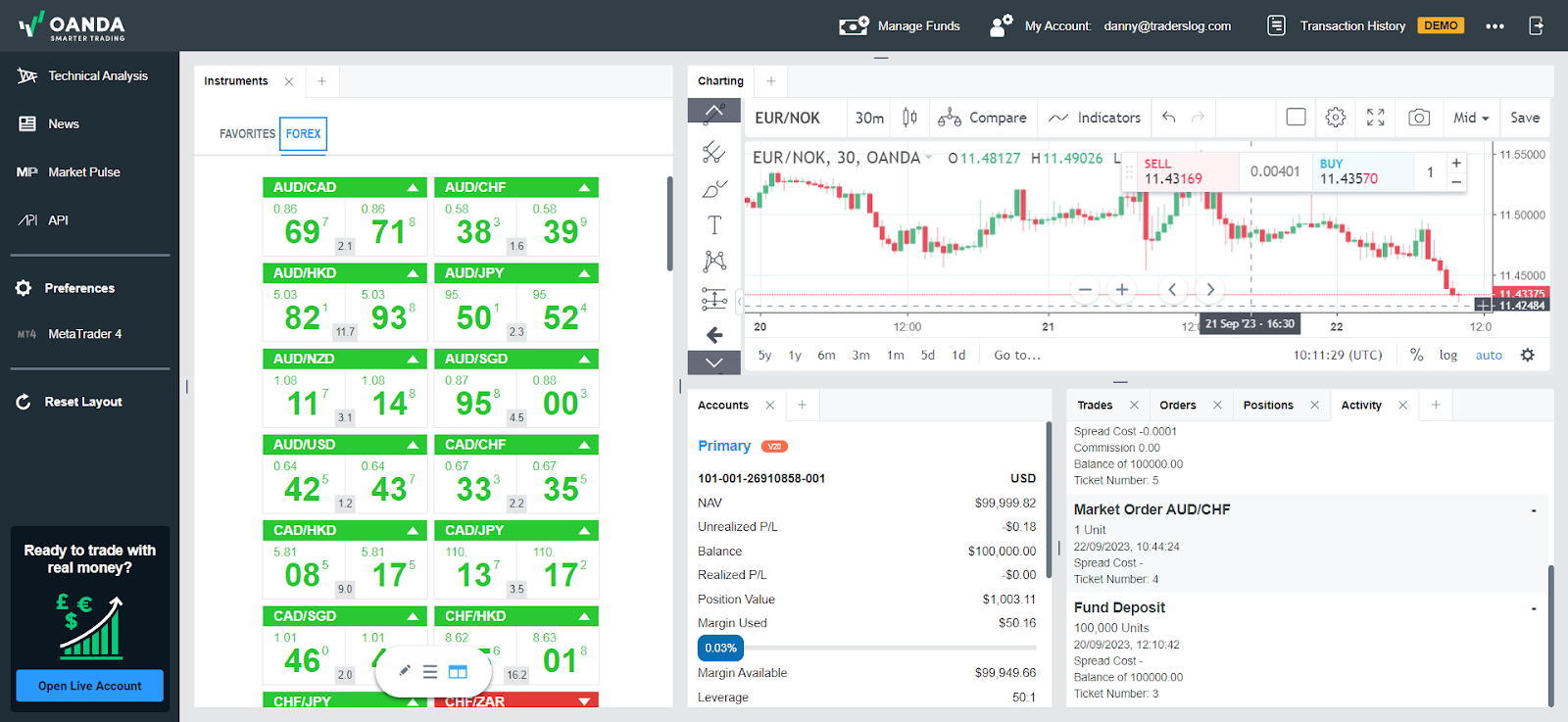

OANDA Web Platform

The OANDA web trading platform is easy to use and has a nice layout that you will love. Additionally, you can change the layout to suit your preferences thanks to its customization features. In this way, traders have access to multiple chart layouts and can monitor up to eight charts simultaneously. This functionality allows traders to monitor charts across multiple instruments and timeframes on a single screen. On the downside, you can’t set price alerts.

- Charts: The platform features TradingView charts, which have over 100 indicators, over 50 drawing tools, 9 time frames, and 11 chart types. Users can also trade directly from the chart.

- Order: The OANDA web platform offers an incredible variety of order types. There are common order types such as market, limit, and stop-loss. Here you have the option to choose “Time Applicable” conditions, which allows you to set the expiration of your stop-loss or limit order for a specific time. Additionally, trailing stop-loss orders are also offered.

Order book, heatmap, and position ratio features have also been integrated into the OANDA web platform.

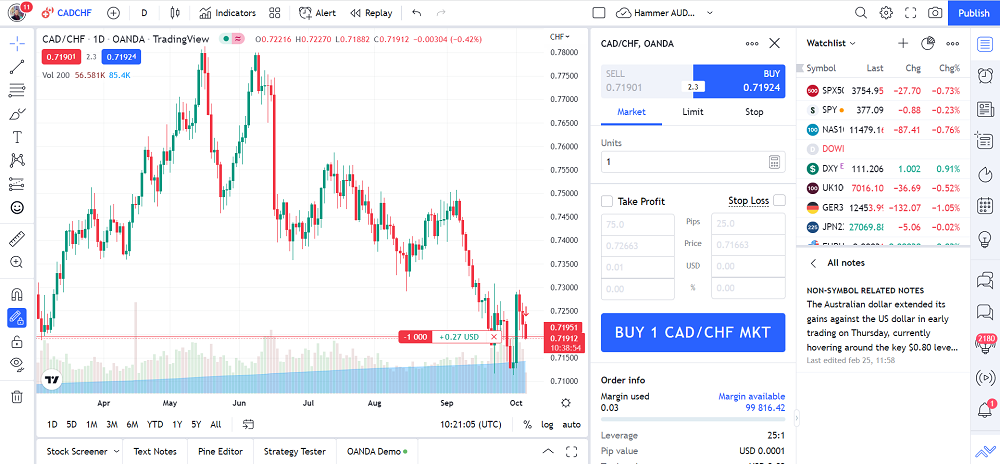

TradingView

The industry-leading TradingView platform offers one-click trading from charts, watchlists, market news, and trading ideas. In this way, traders can easily trade and manage open positions and pending orders from the platform.

- TradingView charts include 11 timeframes, 11 chart types, and over 100 technical indicators.

- It also has a wide range of drawing tools available, from trend lines to Fibonacci retracements.

- The range of order types available is excellent. Market orders, limit orders, stop-loss orders, and trailing stop-loss orders are available.

- Additionally, merchants also have the option to apply time-to-time conditions such as Good-Till-Cancelled (GTC).

Users can draw inspiration from the vast community active on TradingView with features like Idea Stream. The TradingView platform has the rare combination of being powerful in its functionality and being intuitive with a well-designed interface.

Note: While OANDA’s Trade platform is available globally, TradingView is only available to residents of the U.S., U.K., and Canada.

MetaTrader 4 Desktop

OANDA offers MetaTrader 4 for desktops, which has sophisticated features including automated trading and copy trading. There are 39 languages available, from Arabic to Vietnamese. The drawback is that it does not have the most beautiful interface and requires some time and effort to learn, but that is typical of advanced platforms and offers well-loved features such as:

- Alert Function: With the help of this function, traders can be informed when an instrument hits a particular price threshold. The platform can send notifications to a mobile device via email, push notification, or audio.

- Watchlists: In MetaTrader 4, traders can create a list of their favorite instruments and follow live quotes in a market watch panel.

- One-Click Trading: With the help of this function, traders can execute orders with only one click and without a second confirmation. This feature is very helpful for short-term traders since it allows them to operate more quickly.

- Trading from the Chart: Additionally, MT4 gives customers the ease of trading straight from the chart.

The platform offers the following order types:

- Market Order: Market orders are used by traders to buy or sell an instrument at the best available price right now.

- Limit Order: Limit orders are used by traders to purchase or sell an instrument at a predetermined price or above.

- Stop Loss Order: Stop-loss orders are used by traders to buy or sell an instrument when its price hits a predetermined level.

- Trailing Stop Order: Trailing stop-loss orders are used by traders as a stop-loss order at a specific percentage or dollar amount deducted from the current market price of an instrument. When traders are in a profitable trade, trailing stop orders allow them to lock in profits without having to close the position.

Charting feature of MetaTrader 4

- 30 Technical Indicators: These include classic trend indicators, volume indicators, and oscillators.

- 23 Analytical Objects: These include lines, channels, Gann, and Fibonacci tools.

- 9 Time Frames: Traders can choose from nine-time frames, from one minute to one month.

- 3 Chart Types: Bar charts, Japanese candlestick charts, and line charts are all available to traders.

The automated trading and copy trading features of MetaTrader contribute to its popularity.

- Trading Signals: Users of MetaTrader 4 can replicate other traders’ actions in real time by using signals.

- Automated Trading: Expert Advisors (EAs) can be created, tested, and used by users of MetaTrader 4. EAs are algorithms-based trading and market monitoring tools.

MetaTrader 5

MetaTrader 5 (MT5) is now available at OANDA in Japan, the U.K., and in emerging markets, from the broker’s BVI entity. MT5 is not available in the U.S. for OANDA clients.

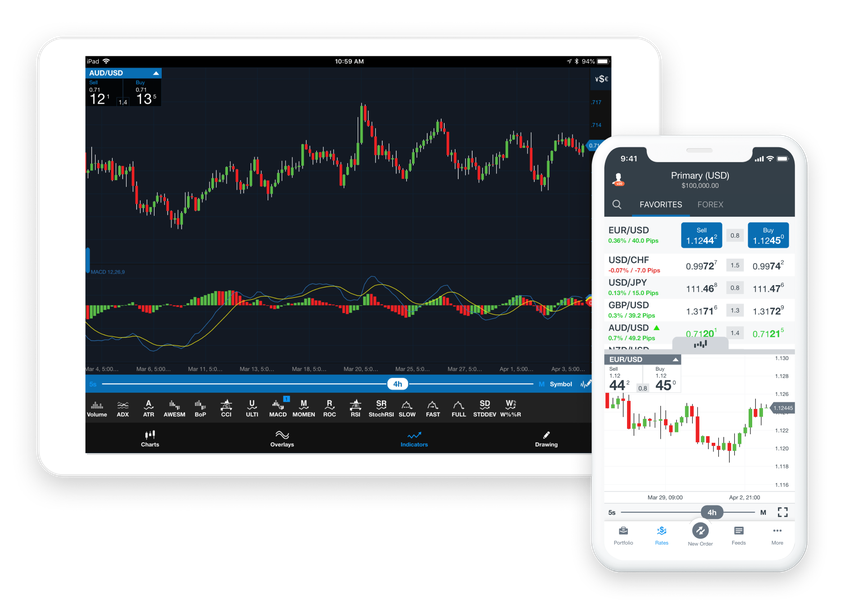

OANDA Mobile App Review

OANDA offers the popular MetaTrader 4 (MT4) mobile app alongside its own proprietary Trade mobile app. It is easy to use and provides quality market research and excellent charting features.

- Charting: OANDA’s flagship Trade mobile app includes 33 technical indicators, 13 drawing tools, and flexible charting with over a dozen timeframes to choose from. The adaptive nature of the apps makes it easy to zoom in and zoom out of the charts while trading.

- Ease of use: The general design of the interface of the OANDA Trade app is easy to use. The charting of the trade app is balanced with features like news headlines and autochartist research, in addition to its user-friendly interface. With a straightforward drag-and-drop feature, users can easily modify their stop-loss and limit order levels after entering their orders quickly from the chart.

Oanda’s mobile platform is similar to the web trading platform in functionality, and as a plus, you can also set price alerts.

OANDA Research and Education

SUMMARY

OANDA excels in research, offering news from Dow Jones and industry-leading analysis from the MarketPulse website. There’s a steady stream of regularly updated textual, video, and audio content available.

OANDA has an impressive range of educational offerings, from platform tutorials to live webinars with industry experts.

With several daily articles, podcasts, and research tools, OANDA gives forex and CFD traders what they need to successfully navigate the markets.

Market Research Overview

A wide variety of research is available for forex traders on OANDA.

- A selection of excellent articles organized by category can be found on its MarketPulse website, which publishes several updates daily.

- News headlines on OANDA’s MetaTrader 4 (MT4) and trading platforms are obtained directly from Dow Jones Newswires, in addition to other sources.

- The broker offers trading signals and automatic technical analysis using its mobile app and web platform, both of which include Autochartist.

- Finally, OANDA publishes daily analysis updates in its Market Insights series.

Market News and Analysis

- OANDA’s MarketPulse website features exclusive news, research, and analysis information. Which are streamed through the OANDA blog and Dow Jones Trade mobile app.

- OANDA also produces its podcast series, called “Market Insight.”.

Education Overview

- OANDA has a respectable selection of printed learning resources, which it balances with staff-led webinars.

- However, there is no wide selection of instructional videos on the YouTube channel.

- One drawback is that OANDA has too much beginner-friendly learning material spread across its website.

OANDA Customer Service

SUMMARY

OANDA offers customer support 24/5 via live chat and phone (212 858 7690). Support via email (frontdesk@oanda.com) is 24/7.

When we tested the customer support with various questions ranging from platform to tradable instruments, the result was satisfactory, like;

- Chat support responded within seconds.

- Emails are usually answered on the same day or within one business day.

- Via phone, it was necessary to navigate a series of automated questions designed to segment callers.

US clients with Forex trading accounts can access assistance from 4:00 p.m. onwards on Sunday. For spot cryptocurrency trading inquiries, the customer support team is available 24/7 from Friday 6:00 p.m. ET.

Security and Reliability of OANDA

SUMMARY

One of the biggest and most established brokers in the forex market is OANDA, and its businesses are governed by numerous regulators globally. The National Futures Association (NFA) and the highly regarded Commodity Futures Trading Commission (CFTC) oversee it. We discovered that OANDA was quite open about its regulatory standing, client costs, and corporate history.

While OANDA doesn’t place the highest emphasis on security, they still do what is necessary to secure the platform and customer data. The company provides a safe environment for trading and is compliant with regulations, but it does not go much beyond that. Additionally, OANDA’s efforts to establish itself as a trusted broker in the online broker sector deserve credit.

- Two-factor authentication (2FA) is available to OANDA customers, like biometric login for the mobile app.

- Fund segregation and negative balance protection are not available to OANDA clients in the United States. Because US regulations prevent FX accounts from having a separate account status, OANDA Corporation keeps client funds in the same bank account as the operating funds.

- In the unlikely event that OANDA Corporation applies for bankruptcy or becomes insolvent, customers’ only recourse may be an unsecured claim against the money they invested. In the event of liquidation, OANDA Corporation will settle all debts owed to creditors before pursuing any unsecured claims.

- The level of protection provided to each account in the case of default is restricted and may differ based on the location of the account, even with the impressive level of regulatory control. For instance, OANDA Asia Pacific Pte. Ltd. provides guaranteed stop-loss orders, and OANDA Europe Ltd. provides negative balance protection mandated by ESMA. US customers are the exception, as OANDA Corporation does not provide any such protection to their accounts.

- In the event of broker insolvency, traders in the EU and the UK can also use investor compensation schemes. For example, the UK Financial Services Compensation Scheme (FSCS) covers traders up to £85,000.

- The Commodities Futures Trading Commission (CFTC) has set a maximum leverage restriction of 50:1 on major currency pairs and 20:1 on other pairs for retail forex traders operating in the United States.

OANDA is regulated by the following Tier-1 regulators:

- Australian Securities & Investment Commission (ASIC),

- Canadian Investment Regulatory Organization (CIRO),

- Japanese Financial Services Authority (JFSA),

- Monetary Authority of Singapore (MAS),

- Financial Conduct Authority (FCA),

- Commodity Futures Trading Commission (CFTC),

- Regulated in the European Union via the MiFID passporting system.

Final thoughts

OANDA’s edge is its strong regulatory track record with over 25 years of experience, and it also delivers robust market research content and an excellent mobile app. It provides easy-to-use trading platforms that you may become experienced with very soon. Additionally, it offers strong research resources, particularly for trading APIs. The account-opening process is easy and quick. This makes it suitable for novice and experienced traders. OANDA’s limited selection of only 124 tradable goods and its uncompetitive pricing compared to the top low-cost brokers are its main weaknesses.

FAQs

What is the minimum deposit for OANDA?

There is no minimum balance or deposit required to activate a live account at OANDA, but the Premium requirements can be as high as $20,000, depending on the jurisdiction.

If we talk about trade size, unlike most brokers that offer micro contracts (1,000 units) as the smallest trade size, OANDA allows you to trade as little as 1 unit of the currency while trading forex.

How much is the maximum leverage at OANDA?

Leverage on OANDA depends on the instrument you are trading and whether you are a retail or professional client. When compared to other reliable brokers, OANDA’s leverage is somewhat normal. Financial regulations in the UK and EU cap leverage at 1:30, which means that you can open a trade position worth up to 30 times the value of your deposit.

For example, with a deposit of $100, you can open a trade of $3,000 to increase your profit potential. Note that it also exposes you to more risk.

The allowable leverage varies based on the product you wish to trade. Here are the options:

| Product (CFDs) | Max. Leverage | Margin |

|---|---|---|

| Forex | 1:30 | 3% |

| Cryptocurrency | 1:20 | 50% |

| CFD | 1:20 | 5% |

What are the spreads in OANDA?

Spread trading, as opposed to commission trading, is how OANDA generates revenue. These are based on specific main currency pairings and are varied, starting at 0.2 pip and increasing from there.

| Product (CFDs) | Average Spread | Fixed or Variable? |

|---|---|---|

| Forex | 0.2 pips | Variable |

| Cryptocurrency | 6 pips | Variable |

| CFD | 0.8 pips | Variable |

Is OANDA a good broker?

OANDA is considered a good broker because commission-free trading, negative balance protection for ordinary consumers, and monitoring by specialized financial regulators all play important roles. Additionally, their customer service is prompt.

Who should choose OANDA?

OANDA is suitable for both experienced and inexperienced traders. Beginners will find the OANDA web platform user-friendly and suitable. To receive cash rebates, free wire transfers, and access to reputable third-party platforms, experienced traders in the US have the option to open an Elite Trader account.

Is OANDA good for beginners?

OANDA’s Trade platform and client dashboard are user-friendly enough for novices, as seen by its high ranking for ease of use.

What is the duration required to withdraw funds from OANDA?

Withdrawals via debit card take 1–3 business days, and withdrawals via bank wire take 1–5 business days.

OANDA Review Methodology

To compile broker reviews, we thoroughly investigate, verify, examine, and compare the elements that we consider the most important to consider when choosing any broker. It contains the benefits, drawbacks, and overall grades our research determines. We aim to help you find the ideal broker for your investor needs. You can read more about our review process by visiting this page.

78.3% of retail investor accounts lose money when trading CFDs with this provider. CFDs are complex instruments, with a high risk of losing money rapidly due to leverage. Consider whether you understand how CFDs work and can afford the high risk of losing your money.