Interactive Brokers Review 2024

KEY TAKEAWAYS

- Investor protection is available to many users, e.g., $500k (securities up to $500k, cash up to $250k) for US clients.

- Multiple top-tier regulations, including FCA in the UK, SEC in the US, and ASIC in Australia

- A spotless record with no significant regulatory violations or fines

- CFDs are banned in the US. You won’t be allowed to trade CFDs if you live in the US.

For many years, Interactive Brokers has dominated the digital brokerage market. This brokerage offers the lowest commission and margin rates in the industry (including international trading). Globally, clients from over 33 countries can trade in over 150 markets.

In this Interactive Brokers review, we will look at how this broker measures up on the key factors that we feel are the most important to consider before opening an account.

Best for:

| CFD trading | 96% |

| Low spread forex trading | 96% |

| Investing online | 96% |

| Founded | 1978 |

| Headquarters | Greenwich, Connecticut, U.S. |

| Products offered | Stock, ETF, Forex, Fund, Bond, Options, Futures, CFD, Crypto, Warrants, Structured Products, Commodities |

| Account Type | Individual and professional account |

| Deposit and withdrawal option | Bank transfer (Deposit by debit card is only available to US customers.) |

| Trading Platforms | Client Portal, Trader Workstation, IBKR Mobile, IBKR GlobalTrader Mobile, Impact Mobile |

| Country of regulation | USA, Ireland, UK, Hungary, India, Australia, Canada, Japan, Hong Kong, Singapore |

| Minimum Deposit | $0 |

| US stock fee | Fixed pricing: $0.005 per share, min. $1, max. 1% of trade value. Free for US clients choosing IBKR Lite plan. |

| Withdrawal fee | $0 |

| Inactivity fee charged | No |

| Available base currencies | AED, AUD, BGN, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, IDR, ILS, JPY, MXN, MYR, NOK, NZD, PLN, RON, SAR, SEK, SGD, USD, TRY, ZAR |

| Conversion fee of deposits in non-base currency | Trade value less than $1 billion: 0.2 bps * trade value; min. $2 |

| Deposit with bank card | Not available |

| Deposit with electronic wallet | Not available |

| Time to open an account | 1-3 days |

| Demo account provided | Yes |

Interactive Broker’s Pros and Cons

Pros

-

Low commissions and fees

-

Low margin rates

-

A vast range of investment offerings

-

Superior order execution

-

Robust trading platform with a vast array of technical and fundamental trading tools

-

Designed with international traders and investors in mind

Cons

-

Complicated account opening process

-

Uses complex tiered pricing plans

-

Some research tools incur a fee.

Interactive Brokers: A Summary

Interactive Brokers is one of the largest US-based and lowest-spread brokers, regulated by many top-tier regulators globally. They provide commission-free stock and ETF trading.

It keeps adding new features like mobile apps or ESG screening to complement its consistent strength in trading platforms, tradable securities, and low-margin rates. Clients can trade stocks, options, futures, forex, cryptocurrencies, bonds, and funds on 150 markets from a single, integrated account. IBKR has over 2.43 million customer accounts and a daily trading value of $1.91 million.

Our Take on Interactive Brokers

Interactive Brokers (IBKR) is highly recommended for those who:

- Looking for a broker with excellent all-around services at low fees.

- It provides an unmatched assortment of asset classes from exchanges worldwide and a multitude of trading platforms with excellent functionality and cutting-edge research.

- The IBKR Global Trader app is a great way to start trading stocks, ETFs, options, and crypto, even for beginners.

- More experienced users may enjoy the complex capabilities of Trader Workstations at the other end of the spectrum.

- The broker also has some drawbacks, like the fact that opening an account is long and tedious. Some platforms may be too complex for beginning traders, and customer service may also be busy.

Types of Accounts

Interactive Brokers offers a wide range of account types to meet the needs of its clients. International Accounts in the US Available to those living outside the U.S.

Individual account types include

- Individual and joint brokerage

- Retirement: Individual retirement accounts (IRAs), including rollover, regular, Roth, and inherited ones

- Custodial: The Uniform Transfer to Minors Act and the Uniform Gifts to Minors Act (UGMA) (UTMA)

- Trust

Professional account types include

- Family office

- Small business: unincorporated business structure, LLC, partnership, and corporation

- Advisor

- Hedge and mutual fund

- Institutional

Range of Investment Options Available

Interactive Brokers offers a wide range of asset classes. They frequently add new options and features in response to consumer demand. In addition, they rapidly establish relationships with new electronic exchanges, as a result of which they today offer a wide range of international investment opportunities. In which they provide access to the markets of 33 countries. Clients can trade in more than 48,000 mutual funds, of which approximately 19,000 are no-transaction-fee funds, and all funds in its marketplace are no-load.

They also offer fractional share trading, where you can buy less than a full share of stock depending on your budget. Overall, Interactive Brokers offers the following investment options to traders:

| Offering | Description | Availability Status |

|---|---|---|

| Stocks | Over 17,500 U.S. available to borrow | Yes |

| ETFs | PRO users can access 150+ no transaction fee ETFs | Yes |

| Mutual Funds | One of the world’s largest mutual fund marketplaces with over 48,000 funds and 19,000+ no transaction fee funds | Yes |

| Bonds | Corporate, municipal, treasury, CDs, international | Yes |

| Options | Available globally on 30+ market centers | Yes |

| Futures | Futures and futures options | Yes |

| Forex | 24 currencies and 100+ trading pairs | Yes |

| International Markets | 150 exchanges in 33 countries where you can trade stocks, options, futures, forex, bonds, funds, and contracts for differences (CFDs) from a single integrated account | Yes |

| Penny Stocks | Over-the-counter bulletin board (OTCBB) | Yes |

| Fractional Shares | Fractional trading on U.S. companies that are listed on the NYSE, AMEX, NASDAQ, ARCA, or BATS; also, on OTC Pink U.S. penny stocks that have a market capitalization of at least $400 million and an average daily volume above $10 million. There are an additional fifteen European stocks and exchange-traded funds that qualify. | Yes, |

| Cash Management Services, | Unlike other platforms which require clients to open a separate cash management account, at IBKR the cash management features are integrated within a single account. Using a mobile device, you can deposit money, pay bills, borrow money, and transfer cash. A formula is used to calculate interest on cash holdings, with greater sums earning higher interest rates. | Yes |

| Robo-advisory | Interactive Advisors, integrated into the website and IBKR Mobile | Yes |

| Advisory Services | No | |

| Cryptocurrency | Not yet, but they plan to |

Interactive Brokers’ Commissions and Fees

One of the greatest margin rates on the market is offered by Interactive Brokers, along with cheap trading costs. It offers two pricing plans: IBKR Pro (meant for professionals) and IBKR Lite (for casual investors).

| Particulars | IBKR Lite (for casual investors) | IBKR Pro (meant for professionals) |

|---|---|---|

| Stock trading costs | It offers unlimited commission-free trading for U.S. stocks and ETFs as well as certain mutual funds. | Yes (For details, see Note 1) |

| Options trade | No base commission; 65 cents per contract. | No base commission; 15 to 65 cents per contract depending on commission structure (volume discount available). |

| Margin Rates | Charge a flat 2.6% to finance margin trades of all sizes. | Margin rates range from 0.75% to 1.6%, depending on the amount borrowed, with larger transactions garnering a lower rate. |

| Close or transfer account fees | No | No |

| Inactivity fees | No | No |

| Security reorganization fees | No | No |

| Mutual fund redemption fees | No | No |

Note 1: IBKR Pro charges commissions, offering both fixed and tiered pricing options.

- Under the fixed pricing system, you owe $0.005 per share for stock trades, with a minimum fee of $1 and a maximum of 1% of the total trade value. This includes all exchanges and most regulatory fees.

- The company offers a tiered pricing structure, whereby fees drop as total trading volume increases, for those who execute a high volume of trades each month. It is based on monthly order activity. This ranges from a high of $0.0035 per share for less than 300,000 shares per month to $0.0005 per share if you trade more than 100 million shares per month, with a minimum of $0.35 per trade and a maximum of 1% of the trade value. Regulatory and exchange fees are not included.

The Interest Rate on Uninvested Cash

The minimum balance to earn interest is $10,000.

- IBKR Lite: 3.83% on the portion of the account balance above $10,000.

- IBKR Pro: 4.83% on the portion of the account balance above $10,000.

How to Open an Interactive Broker Account

Opening an Interactive Broker account is completely digital. To open an account, users need to complete the following process:

- Select Interactive Brokers Account Type: First of all, users have to choose the right brokerage account.

- Add personal information: Add your email address and create a username and password of your choice. Fill out the basic information questionnaire, including your name, date of birth, address, nationality, and employment status.

- Enter regulatory information and investment objectives, then provide financial data and objectives as requested by the broker.

- Verify Yourself: Scan and upload proof of your identity. This could be a passport, ID card, or bank statement.

- Sign the contract: Review the information you provided and sign a virtual contract after agreeing to the broker’s terms and conditions.

- Deposit funds into your account: Once your account is confirmed, transfer the minimum deposit amount, or if there is none, transfer the amount you wish to invest. After this, start trading.

Deposit and withdraw funds

Interactive Brokers provides one free withdrawal each month along with numerous account-based currencies. However, the primary disadvantage is that bank transfers are the only option.

The Process of Buying Stock at Interactive Brokers

- First, go to the ‘Trade’ menu on the client portal and select the product you want to trade.

- Then click on “Enter Symbol” and find the product of your choice. Some of the tickers here may have alternative versions on different exchanges.

- After which, choose how many shares or how much investment you want to make.

- Select your order type, limit price, and applicable time (if required).

- Then submit your order.

- Once this is filled out, you will see the status of your order in ‘Trade’ – ‘Orders and Trades’.

Interactive Brokers Platform and Technology

Interactive Brokers support multiple trading platforms, including desktop, web, and several mobile versions, which are available for Android and iOS devices. You can trade the same asset classes on any of these platforms. They have two computer-based platforms and three mobile apps:

- Client Portal

- Trader Workstation

- IBKR Mobile

- IBKR GlobalTrader Mobile

- Impact Mobile

Computer-Based Trading Platforms

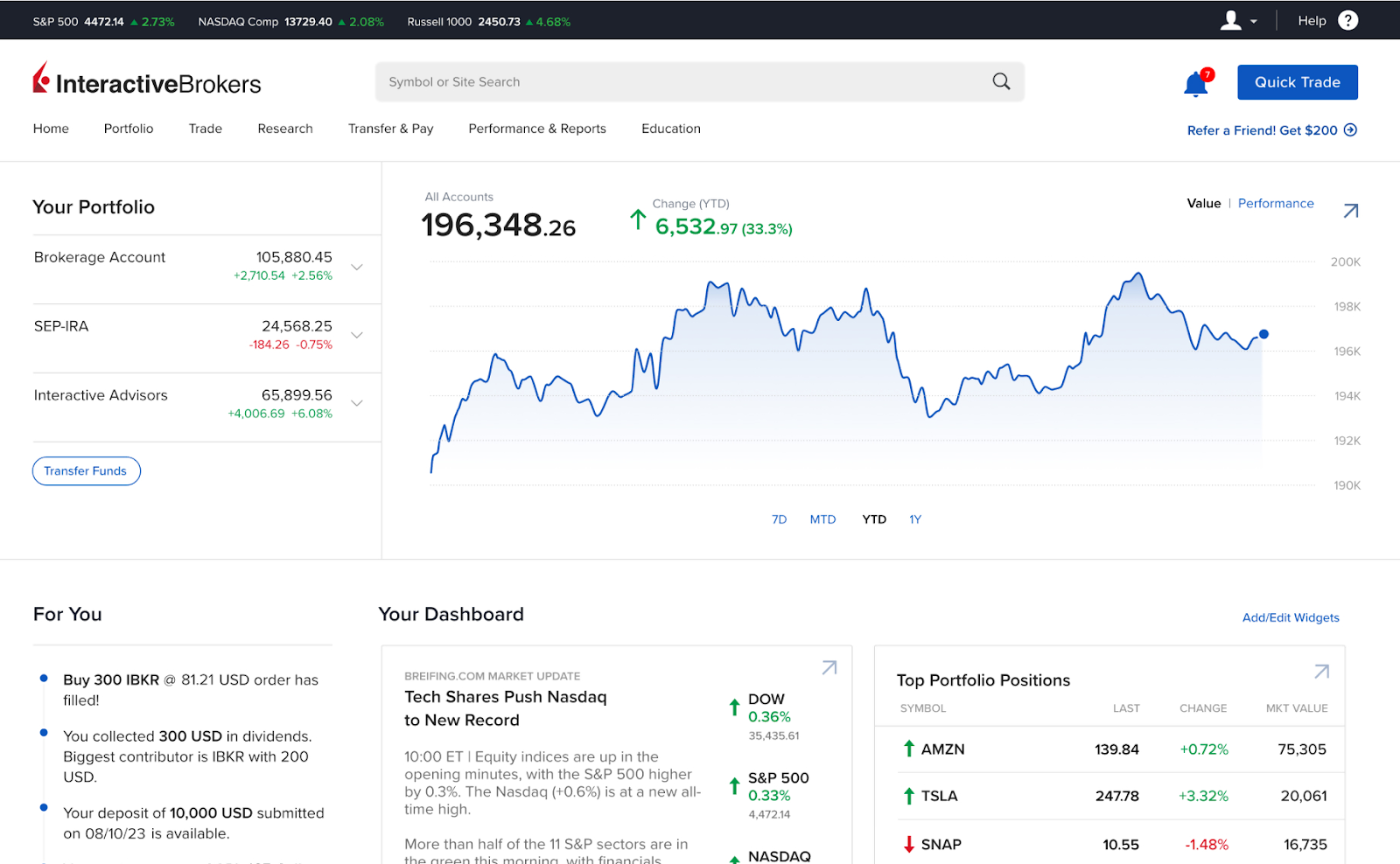

Client Portal

Users can monitor and manage all aspects of their Interactive Brokers account in the Client Portal. As we have discussed above, IBKR is suitable for most intermediate to advanced investors to check their positions, and users can get the following features:

- A real-time view of your accounts

- The user can view detailed quotes.

- Users can enjoy features such as advanced charting, news, access to trade tickets, and setting trade defaults.

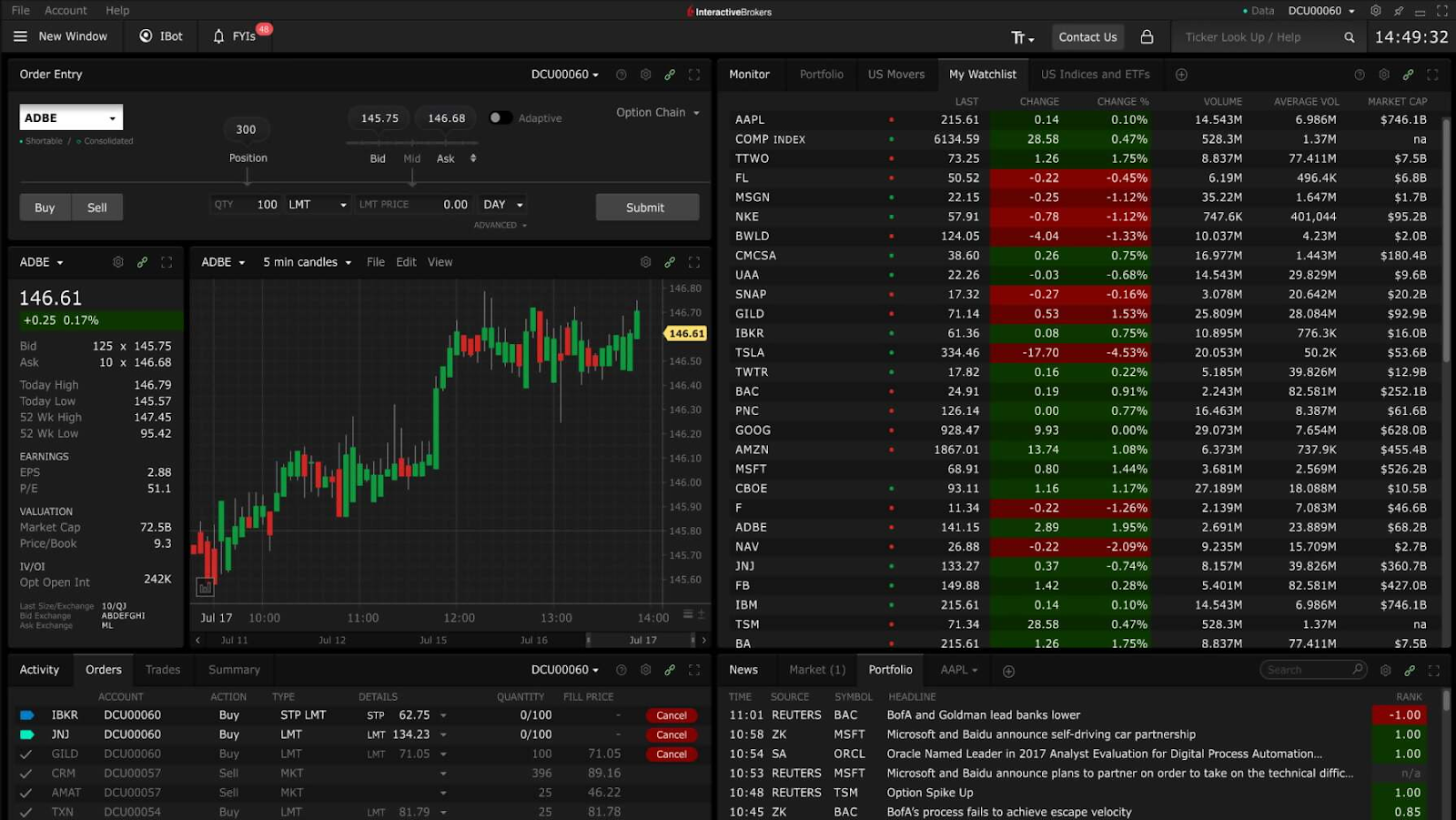

Trader Workstation

It is designed for active traders and investors who demand flexibility with access to multiple products.

- It offers customizable TWS trading, order management, portfolio management tools, and both fundamental and technical charting.

- This gives expert traders access to over 100 order types, including algorithmic trading.

- In this way, investors can place, modify, and manage orders directly from the chart.

Mobile-Based Trading Platforms

IBKR Mobile

The IBKR mobile app is almost similar to the computer-based trading platform and includes

- All include the ability to trade the same types of assets and execute the same orders.

- Additionally, the mobile platform offers the same research capabilities as the client portal, including screeners and option strategy tools.

IBKR GlobalTrader Mobile

With this new app for foreign trading, you may trade equities from your phone or tablet and deposit money in your local currency.

- Users can access 90+ global stock exchanges across North America, Europe, and Asia.

- The app is ideal for both US and non-US investors wanting access to worldwide markets.

Impact Mobile

Impact is Interactive Brokers’ mobile app designed for investors interested in ESG investing. It helps evaluate assets through a socially responsible investment (SRI) lens.

- The Impact app allows users to identify their values and contribute to change in the world, like clean water, racial equality, or climate change.

- Through this, users can screen companies that meet their criteria.

- Through this, your investment can also bring rewards to the environment, you, and your friends.

- Even medium- to small-sized traders can start investing in fractional shares.

Interactive Brokers Research and Education

Interactive Brokers offer extensive educational resources to help people get started investing. These can be important for a novice investor.

- Market Data: Interactive brokers typically provide traders with access to a wide range of market data, including real-time quotes, news, and financial statements.

- Fundamental Analysis: Interactive Brokers provides tools and resources for fundamental analysis, allowing users to assess the financial health and performance of companies.

- Webinars and Workshops: Interactive Brokers frequently conducts webinars and educational workshops covering various topics, such as trading strategies, market analysis, and platform tutorials. Which can be important for investors.

- Tutorials and Guides: Interactive Brokers also offers instructional materials, tutorials, and guides to help clients understand the features of their trading platform as well as broader concepts related to investing and trading.

- Research Reports: Interactive Brokers provides the investor with access to third-party research reports from reputable sources and in-house research reports and analyses covering stocks, sectors, and other financial instruments.

- Daily or Weekly Commentary: Interactive Brokers also offers regular market commentary that discusses current market trends, economic indicators, and potential opportunities.

Interactive Brokers Customer Service

IBKR has failed in customer service at some points, but the company is improving its customer service reach and response time. The following features are available in Customer Services:

- Toll-free telephone support is available 24 hours a day, six days a week.

- A call-back service is available through which you can request a call-back.

- You can have an online chat with a human agent through the website or trading platform.

- Secure messaging is available from within the center, trading platform, or website.

- AI-powered iBot, which directs customers to online FAQs and resources

Security and Reliability of Interactive Brokers

IBKR provides data security procedures that outperform the majority of industry requirements for your account and personal information.

- The Securities Investor Protection Corporation (SIPC) insures client accounts at Interactive Brokers LLC for up to $500,000, with a $250,000 cash sublimit. Up to an additional $30 million is available through excess SIPC coverage, with a cash sublimit of $900,000 and an overall cap of $150 million.

- Users of mobile apps can log in using facial or fingerprint recognition as a biometric.

For securities you purchased or sold through IBKR, the IBKR Securities Class Action Recovery Service will automatically determine whether you are eligible to file a claim. Excluding a 20% contingency fee, the IBKR service will automatically file your claims and help you collect the money you are entitled to.

Transparency at Interactive Brokers

The website of Interactive Brokers provides a comprehensive and transparent view. These generally provide transparency in several ways:

- Fee Structure: Although their fee structure is complex, their platform provides detailed information on commissions, fees, and other charges related to trading. This information is also usually available on their website or through their customer service.

- Account Statements: Clients of Interactive Brokers receive regular account statements that detail their positions, transactions, and account balances. These statements help clients keep track of their investments and understand the costs associated with trading.

- Risk Disclosures: Interactive Brokers, like other brokerage firms, are required to provide risk disclosures to their clients. These disclosures outline the risks associated with different types of investments and trading activities.

FAQs

Who should choose Interactive Brokers?

Interactive Brokers is a superior choice for professional investors, day traders, and anyone serious about trading. Their IB Trader workstation is one of the most comprehensive platforms for researching, tracking, and making investments.

They provide access to worldwide markets in 33 countries and a wide range of investing options, encompassing nearly all major asset classes.

Is Interactive Brokers good for beginners?

For beginner and occasional traders, Interactive Brokers offers attractive benefits. IBKR Lite is designed to be a more approachable platform for those just starting and offers commission-free trades on U.S.-based stocks, exchange-traded funds (ETFs), and mutual funds.

Despite having fewer capabilities than the desktop IB Trader Workstation, the streamlined Interactive Brokers mobile and web interfaces are also simpler to use.

Can I open cash account with Interactive Brokers?

Yes, Interactive Brokers allows you to open a cash account. When using a cash account, you are not allowed to use a margin or borrow money from the broker. You can never lose more money than you initially invested in a cash account.

Is Interactive Brokers free?

Yes, if you use IBKR Lite and are a US citizen, Interactive Brokers is free. IBKR Lite only offers US stocks and ETFs and has no fees.

What is the duration required to withdraw funds from Interactive Brokers?

Depending on your bank and region, withdrawing money from IBKR can take two to four days. Each calendar month, you are permitted to make one free withdrawal.

Interactive Brokers Review Methodology

To compile broker reviews, we thoroughly investigate, verify, examine, and compare the elements that we consider the most important to consider when choosing any broker. It contains the benefits, drawbacks, and overall grades our research determines. We aim to help you find the ideal broker for your investor needs. You can read more about our review process by visiting this page.

66% of retail investor accounts lose money when trading CFDs with this provider. CFDs are complex instruments, with a high risk of losing money rapidly due to leverage. Consider whether you understand how CFDs work and can afford the high risk of losing your money.