The Best US Forex Brokers of 2024

Are you looking for a forex broker to trade with? The foreign exchange market is the world’s largest financial market, with over $7 trillion exchanged every day, five days a week, making the foreign exchange (also known as foreign exchange or FX) market the world’s most active and largest.

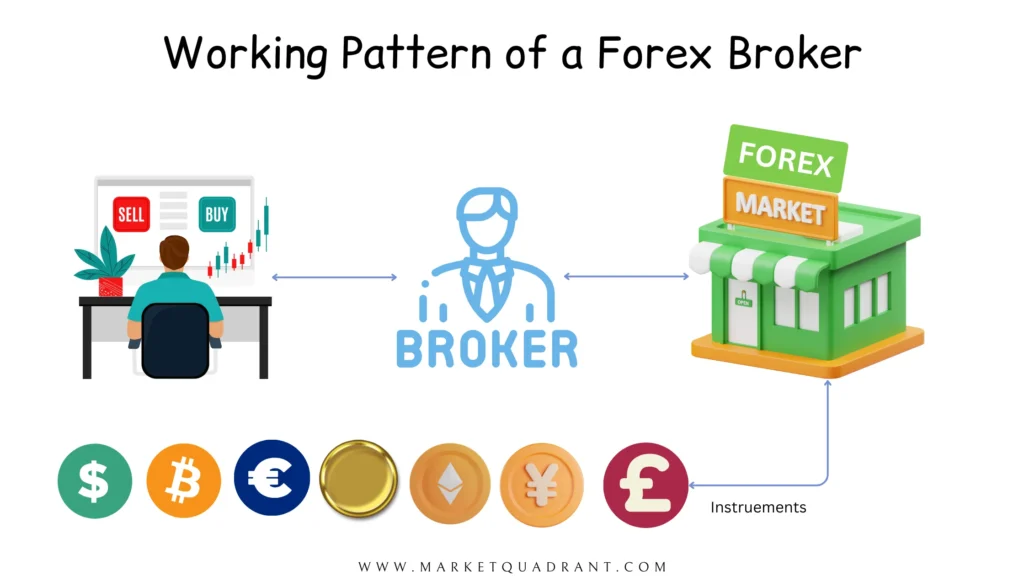

Forex trading involves buying and selling currencies in the global market to make profits from changes in exchange rates. To participate in this market, you must use a forex broker, who acts as an intermediary between you and the market.

In such a situation, choosing the right forex broker is very important. Finding a good Forex broker in the US is not difficult at all, but it becomes difficult due to certain factors like cost and regulations.

As the popularity of forex trading increases in the United States, an increasing number of online forex brokers have begun offering investment products related to currencies.

But before any Forex broker can accept US Forex traders as clients, they are required to be registered as a Retail Forex Dealer (RFED) by the Commodity Futures Trading Commission (CFTC), the financial regulatory body. It is also required to be registered and regulated with the National Futures Association (NFA).

Based on our analysis, we have created a list of our best forex brokers for the United States that meet diverse trading needs. This list can help you choose the best forex broker for you.

-

IG: Most trusted, great for beginners, First-class web trading platform. Superb educational tools.

-

TD Ameritrade: Best desktop platform (U.S. only)

-

FOREX.com: Competitive forex spreads. Diverse technical research tools.

-

Interactive Brokers: Best for professionals

-

OANDA: Outstanding research tools. Fast and user-friendly account opening.

-

Plus500: Best Broker for Future Trading

When selecting a Forex broker in the United States, we have carefully evaluated everything and focused on the features that are most important for any good Forex broker.

- First, we have confirmed that each broker we recommend accepts US clients, is CFTC-registered, and is a member of the National Futures Association.

- We also considered the top-notch financial strength as well as the disclosure issues about the recommended Forex brokers.

- The recommended Forex brokers come with a trader’s arsenal with a plethora of assets such as major, minor, and exotic currency pairs.

- The difference in the fees and the trading charges of the respective Forex brokerage houses were checked. Namely, they were spreads, commissions, swap fees, inactivity fees, and withdrawal fees, and the ones offering the best prices were chosen.

- After the evaluation and comparison between different platforms, we finally decided to use brokers having some main features that those are advanced charting, multiple order types, one-click trading, watchlists, alerts, and an intuitive interface.

- Furthermore, included with our list are brokers who are providing information-rich investing materials that will equip traders to better comprehend the financial market and improve their trading skills leading to well-informed decisions

Pros and Cons

Pros

-

Extensive range of offerings

-

No minimum deposit

-

No withdrawal fee

-

Free demo account

-

Excellent web and mobile platforms

-

Superb educational tools

Pros

-

High stock CFD fees

-

No copy trading or backtesting integration

-

Limited product portfolio

-

No account protection and no guaranteed stop losses for U.S. clients

-

A minimum deposit of £250 is required if transferring through PayPal or debit cards.

-

While IG’s flagship platforms are best in class, MT5 is unavailable.

Fees

| Minimum Deposit | $0 |

| Inactivity Fee | $12 |

| Account fee | No |

| Deposit Fee | $0 |

| Withdrawal Fee | $0 |

Review

IG was founded in 1974, and today it has become a global leader in the online trading industry. It is the largest online CFD provider as well as one of the most competitive platforms available in terms of fees.

This is a more specialized broker focused on Forex, and it is open to US investors. IG has more than 300,000 clients globally and is also a London-based publicly traded company included in the mid-cap FTSE 250 index of the London Stock Exchange.

IG provides access to a wide range of markets and products with relatively low trading costs. It allows spreads as low as 0.8 pips (a pip is one ten-thousandth of a point) on the most traded currency pairs. Additionally, it claims that its prices are at least 20 percent lower on the Euro-Dollar pair than top US brokers.

The broker also provides a web platform, a smartphone app, and access to the MetaTrader4 and ProRealTime platforms. The clean, clear design of the web platform can be conveniently configured to suit your style, giving you the flexibility to move windows around and change the layout.

It also offers a free demo account if you want to trade with risk-free funds or are a beginner.

In addition to the excellent IG Academy, the IG Forum is a great place to share and discover trading ideas and discuss market opportunities, whether you are a beginner or a more experienced trader. Read the full review.

Trading Platform

IG serves beginner Forex traders with two primary platform options:

- Exclusive proprietary platform

- MetaTrader 4 (MT4).

The proprietary platform is especially suitable for newcomers, offering a user-friendly interface that eases the new user into the trading process. The platform is accessible on a variety of devices, including web, tablet, and mobile apps, ensuring compatibility with both Android and iOS systems.

Trading Assets

An industry-leading 17,000+ markets, including more than 80 currency pairs, 38 commodities, 34 indices, and over 10,000 UK and foreign stocks, are available for traders to wager on with IG.

Who should use IG?

IG is the best choice for traders of all levels. Nevertheless, it is especially good for beginners as it offers unlimited use on a demo account and a wide range of well-collected educational materials.

Key features

| Instruments to trade | 17,000+ |

| Multiple trading platforms | IG’s proprietary online trading platform; mobile trading app; IG’s progressive web app (PWA); ProRealTime (PRT); MetaTrader 4 (MT4). |

| Demo account | Unlimited use |

| Regulation | FCA, ASIC, CFTC |

| Customer services | Telephone (24/5), email, or X client help |

Pros and Cons

Pros

-

TD Ameritrade is trusted by over 11 million clients, with over $1 trillion in assets.

-

Low trading fees (free stock and ETF trading)

-

Exchange-traded forex futures, currency exchange-traded funds, and options on forex futures enhance TD Ameritrade’s already excellent forex portfolio.

-

Extensive research and educational materials

-

Superior client service with 24-hour support

Pros

-

Beginners can find the trading platform challenging to understand.

-

Cannot use bank cards and electronic wallets for money transfer

-

Forex pricing is slightly higher than the industry average

-

Does not offer copy trading or MetaTrader (MT4).

-

Forex is not as heavily emphasized in live video programming as stocks and futures are.

Fees

| Minimum Deposit | $0 |

| Inactivity Fee | No |

| Account fee | $75 full transfer fee/partial transfer is free |

| Deposit Fee | No |

| Withdrawal Fee | No |

Review

TD Ameritrade is one of the biggest and most well-known brokers in the US. It offers a range of tradable products, and currency complements its portfolio. Beginner investors will find it easy to get started with no balance minimums and straightforward pricing.

Following its acquisition by Charles Schwab, TD Ameritrade has improved its offerings for all American clients. The collaboration unlocked access to the acclaimed “thinkorswim” trading platform, expanding the online broker’s library of educational resources and increasing the level of specialized support available to traders.

The broker uses spread pricing and offers 1:50 leverage, which is the lowest in the U.S. and the legal maximum allowed. It also offers over 70 currency pairs, which provides plenty of options.

The broker does not charge an inactivity fee; deposits are free, and withdrawals are free if you utilize an ACH transfer. Clients are covered by a large investment protection amount, however negative balance protection is not available.

TD Ameritrade also allows clients to trade Bitcoin futures, although you will need to get approval to trade in the future.

Customer support is easily accessible via several means, and with no balance requirements and very low, clear pricing, newbies can feel at ease entering the market.

Trading Platform

TD Ameritrade offers two high-featured platforms with which you can do a lot.

- Web platform: The broker’s basic platform handles all of the fundamentals, including trading stocks, bonds, ETFs, mutual funds, and options. It also provides streaming news, third-party research, and watchlists.

- Thinkorswim platform: The thinkorswim platform is designed for advanced traders, allowing them to add indicators, create trendlines, and perform technical analysis via the portal.

Trading Assets

Stocks, ETFs, bonds, mutual funds, options, futures, and Forex.

Who should use TD Ameritrade?

TD Ameritrade is suitable for US-based traders looking for a comprehensive trading experience using one of the most technologically advanced platforms, thinkorswim. This platform is ideal for traders that require in-depth research, customizable screens, and a variety of professional charting tools. It is perfectly suited to the needs of both novice and experienced investors.

Key features

| Instruments to trade | Stocks, ETFs, bonds, mutual funds, options, futures, and Forex. |

| Multiple trading platforms | There are two platforms: TD Ameritrade (web/mobile) and Thinkorswim (desktop/mobile). |

| Demo account | Yes |

| Regulation | SEC and FINRA |

| Customer service | Phone 24/7, email, More than 175 branches, Facebook/Twitter messaging |

Pros and Cons

Pros

-

Tight spreads across a variety of currency pairs

-

Multiple high-quality platforms

-

Wide range of markets

-

Excellent market research

Pros

-

Inactivity fees

-

Fewer instruments (only 600) are available on the MT5 platform compared to the non-Meta Trader platform (about 4,500).

-

High stock CFD fees

-

The demo account expires after 90 days

-

Desktop platform not user-friendly

Fees

| Minimum Deposit | $100 |

| Inactivity Fee | Yes |

| Account fee | No |

| Deposit Fee | No |

| Withdrawal Fee | No |

Review

FOREX.com is a reliable name that offers a great trading opportunity to Forex and CFD traders all over the world. As the name implies, it is a broker from the United States that deals in currency trading but also in metals and future contracts and has lots of appealing features.

FOREX.com offers average spreads that are higher than some low-cost brokers. They have a huge selection of markets and provide access to over 80 currency pairs. Due to its success with clients, FOREX.com claims to be the number one forex broker in the US in terms of the assets it holds. Read the full review.

Trading Platform

It offers an advanced trading platform across both desktop and web platforms, which is delightfully easy to use. The trader can access the widely used MetaTrader 4 (MT4) and MetaTrader 5 (MT5) as well as the broker’s trading platforms in web and mobile versions.

Trading Assets

These provide traders access to various derivatives such as forex, shares, precious metals and futures and options.

Who should use FOREX.com?

FOREX.com is suitable for scalpers, high-frequency, high-volume, and algorithmic traders. With Forex.com clients can choose the pricing structure that best suits them: spread or commission. It is also a popular broker for those looking for an ECN-style account type in the United States.

Key features

| Instruments to trade | Currencies, Crypto, Indices, Commodities |

| Multiple trading platforms | MT4, MT5, and Forex.com Platforms |

| Demo account | Yes |

| Regulation | CFTC US (United States), NFA US (United States) |

| Customer services | Phone, live chat, or email 24 hours a day during market hours. |

Pros and Cons

Pros

-

Low commissions and fees

-

Wide range of global markets

-

Competitive commission and margin rates

-

Robust platform for professional traders

-

Thorough research offering

Pros

-

The Trader Workstation platform is probably too advanced for beginning traders.

-

Complicated account opening process

-

Some research tools incur a fee.

Fees

| Minimum Deposit | $0 |

| Inactivity Fee | No |

| Account fee | No |

| Deposit Fee | No |

| Withdrawal Fee | No |

Review

Interactive Brokers is a publicly traded broker and is known for its low costs and powerful trading platform, which is preferred by active and professional traders.

US clients trading Forex with IB get tight spreads and volume-level pricing. Besides, IB’s Forex clients gain access to an advanced trading system and real-time quotes from some of the largest foreign exchange-dealing banks in the world.

IB provides two accounts for retail traders. First, the IBKR Lite account has no commissions when it comes to trading in U.S.-listed stocks and ETFs. Second, the IBKR Pro account allocates audible tier pricing to all traders.

Moreover, IB’s other financial instruments come with competitive rates. Options contract prices are between $0.15 and $0.65 per contract, futures at $0.25, and mutual funds have a maximum of $14.95 per transaction.

With Interactive Brokers traders can trade stocks on international exchanges as well as place forex orders to hedge their currency. Apart from this, traders can also trade popular cryptocurrencies like Bitcoin and Ethereum at attractive commissions. It also has a competitive fee structure and discounts for high-volume traders.

What we didn’t like during our research was that retail spot forex is only offered to non-US clients. Also, IB’s desktop platform is too complex for inexperienced traders and other things we don’t like are that the platform lacks forex charts. Read the full review.

Trading Platform

Interactive Brokers provides a variety of trading platforms to meet different trading preferences and expertise levels:

- IBKR Trader Workstation (TWS): A comprehensive platform for intermediate to advanced traders, offering trading across multiple financial markets

- IBKR Desktop: A streamlined desktop platform ideal for beginner to intermediate traders, with a user-friendly interface

- IBKR Mobile: IBKR Mobile is a mobile trading platform for traders who require immediate access to global markets and resources.

- IBKR GlobalTrader: IBKR GlobalTrader is an app developed for beginners that allows you to trade stocks, ETFs, options, and cryptocurrency.

- IBKR Client Portal: A web-based platform for easy account management and trading, appropriate for all levels of traders.

The application suits audiences of experts who have vast experience in trading activities. WTS provides such parallel benefits as comprehensive market analysis, strategy testing, and trade execution in more than 150 financial markets around the world. The program offers high customization via multiple interfaces including the app for the desktop, web access, and mobile version.

Trading Assets

Stock, ETF, Forex, Fund, Bond, Options, Futures, CFD, Crypto, Warrants, Structured Products, Commodities

Who should use Interactive Brokers?

Interactive Brokers is best suited to professional traders and experienced investors looking for a full-service multi-asset Forex broker offering a comprehensive platform with competitive costs across multiple global financial markets.

Important: To trade forex with Interactive Brokers in the United States, you must be classed as an Eligible Contract Participant (ECP). An ECP is typically an individual or entity with assets worth more than $10 million, or $5 million if trades are hedged.

Key features

| Instruments to trade | Stock, ETF, Forex, Fund, Bond, Options, Futures, CFD, Crypto, Warrants, Structured Products, Commodities |

| Multiple trading platforms | Trader Workstation and IBKR Platforms |

| Demo account | Yes |

| Regulation | NFA, CFTC, CBI, ASIC, FCA, MAS, CIRO, JFSA |

| Customer service | Email, live chat, and 24/7 phone support. |

Pros and Cons

Pros

-

The OANDA offers tight spreads

-

Extensive currency pair options

-

The OANDA Trade mobile app strikes a good balance between functionality and ease of use.

-

User-friendly proprietary platform

-

Its MarketPulse hub provides high-quality research papers and daily analytical updates.

-

Reliable customer support

Pros

-

Inactivity fee

-

Negative balance protection is not provided

-

OANDA’s spreads are below average, trailing discount leaders CMC Markets and IG by a wide margin.

-

Offers fewer video market updates than its peers.

Fees

| Minimum Deposit | $0 |

| Inactivity Fee | Yes |

| Account fee | No |

| Deposit Fee | No |

| Withdrawal Fee | First card withdrawal each month is free |

Review

OANDA was founded in the United States in 1996. It offers a wide range of financial services to its customers in most countries of the world, and today it is a trusted global brand with a clean regulatory record.

It offers a high-quality and user-friendly trading platform, as well as extensive research tools such as multiple technical indicators and a robust API.

OANDA excels at providing diverse currency pairs and a transparent and competitive pricing strategy. Their platform has been enhanced with TradingView, which offers more charting capabilities.

The account opening process is user-friendly and quick. It also allows cryptocurrency trading through Paxos, allowing you to trade a handful of digital currencies, including the most popular, Bitcoin and Ethereum.

Bitcoin commissions are as low as 0.25 percent. However, OANDA’s limited range of tradable markets and below-average pricing keep it behind the best forex brokers.

Tight spreads with no commission fees

Pricing in Forex trading is typically based on spreads that are consistently lower than the industry average, with OANDA’s standard account spreads typically being 18.5% lower than the industry average.

Additionally, clients with over $10 million in monthly volume can take advantage of the broker’s Elite Trader pricing structure and receive deep discounts.

| Particulars | GBP/USD | USD/JPY | EUR/GBP | AUD/USD | USD/CAD | EUR/JPY |

|---|---|---|---|---|---|---|

| OANDA minimum spread | 1.50 | 1.30 | 1.20 | 1.10 | 1.50 | 1.50 |

| Industry average spread | 1.57 | 1.44 | 1.66 | 1.54 | 1.82 | 1.95 |

Across all major currency pairs, OANDA routinely maintains lower spreads, frequently more than halving industry average costs. Read the full review.

Trading Platform

OANDA clients in the US can access multiple platforms: OANDA Web, MetaTrader 4, TradingView, and the OANDA Mobile App.

Trading Assets.

- Bonds: Trade 6 government bonds, including the UK 10-year gilt and the US 5-year T-note.

- Stocks: Over 1600 shares, including big US companies like Amazon, Tesla, Netflix, and Meta, plus 1,600+ individual stocks

- Indices: Speculate on 15 major global indices, including the FTSE100, S&P500, DE30, and ASX200.

- Forex: Trade 68 major, minor, and exotic currency pairs, such as EUR/USD, USD/CAD, AUD/JPY, and GBP/USD.

- Commodities: Speculate on over 12 precious metals, energies, and soft commodities, including Brent crude oil, wheat, gold, and silver.

- Cryptocurrencies: There are 18 crypto tokens available for trading against the USD, including Bitcoin, Ethereum, and Litecoin. OANDA’s partnership with Paxos provides access to spot crypto trading but does not allow crypto deposits or withdrawals.

- ETFs: A strong range of 41 share baskets are available, covering a range of sectors including technology, healthcare, and raw materials.

Who should use OANDA?

OANDA is best suited for US traders seeking robust trading tools and market access. It is aimed at people who want a trading platform that combines simplicity with advanced features like performance metrics and personalized watch lists.

Key features

| Instruments to trade | 69 currency pairs and 8 cryptocurrencies |

| Multiple trading platforms | OANDA Web platform and Mobile App, MetaTrader 4, TradingView |

| Demo account | Yes |

| Regulation | NFA/CFTC, FCA, CIRO, ASIC, MAS, JFSA, FSC, KNF, MFSA |

| Customer support | Dedicated support team for US customers via phone, live chat, and email |

Pros and Cons

Pros

-

Have Competitive commissions

-

Standard, Mini, and Micro contracts

-

Unlimited Demo Account

-

Cutting-edge WebTrader platform

-

Feature-rich mobile app

Pros

-

Limited Educational Resources

-

No phone support

Fees

| Minimum Deposit | $100 |

| Inactivity Fee | If you don’t use the platform for more than 3 months you’ll have to pay $10 a month. |

| Account fee | No |

| Deposit Fee | No |

| Withdrawal Fee | No |

Review

In 2018, Plus500 entered the U.S. market, giving users access to micro and short-term futures contracts. Plus500 is a simple but powerful web platform and mobile app for all levels of futures trading users. It offers over 2,800+ CFDs on its trading platform with competitive spreads and no commissions.

It is precisely designed for novices in the business. Plus500, among the other full-featured brokers across the globe, launched in 2008, has been available in more than 50 nations with a population of 400,000 active customers.

The CFTC and NFA regulate it and ensure that active trading is accessible to almost all who have a minimum payment of just $100, competitive fees, and low-margin resistance beginning and throughout the upcoming few days in the environment of many sorts of futures.

Plus500 pricing was somewhat average for the industry. Plus500’s minimum day trading margin is intentionally small to make it attractive and easy for traders to monitor their investments.

Trading Platform

A significant investment has been made by Plus500 in its proprietary WebTrader platform, which has made trading as simple as possible. WebTrader is jam-packed with a range of commonly used features, such as watchlists, trading from charts, and live chat support directly within the platform.

Trading Assets

Plus 500 offers trading in forex, cryptocurrencies, agriculture, metals, interest rates, energy, and equity index futures.

Who should use Plus 500?

Plus500 is designed for individuals who want access to a variety of financial markets at cheap trading costs and a simple, functional platform to conduct transactions.

Key features

| Multiple trading platforms | Plus500 WebTrader, iPhone/iPad, Android app and Windows app |

| Demo account | Yes |

| Regulation | Plus500 has multiple regulations around the world |

| Customer support | Dedicated support team for US customers via live chat and email |

Key features of the top forex brokers in the US in 2024

| Broker | Time to open account | FX commission per lot | Credit/debit card | Minimum deposit |

|---|---|---|---|---|

| IG | 1-3 days | No commission is charged | Only debit card | $0 |

| TD Ameritrade | 1-3 days | No commission is charged | No | $0* |

| FOREX.com | 1-3 days | No commission is charged | Only debit card | $100 |

| Interactive Brokers | 1-3 days | Trade value less than $1 billion: 0.2 bps * trade value; min. $2 | No | $0* |

| OANDA | 1-3 days | No commission is charged | Credit/debit card | $0 |

| Plus500 | 1 day | No commission is charged | Credit/debit card | $100 |

Fee comparison of the best US forex brokers

For a forex trader, spreads are the most significant expense component. For the most widely used currency pairings, we gathered the most recent spreads that these online brokers were charging.

| Broker | GBP/USD spread | AUD/USD spread | EUR/CHF spread | EUR/GBP spread |

|---|---|---|---|---|

| IG | 0.9 | 0.9 | 2.0 | 0.9 |

| TD Ameritrade | 1.3 | 1.2 | 2.1 | 1.3 |

| FOREX.com | 1.5 | 1.4 | 2.7 | 1.5 |

| Interactive Brokers | 0.4 | 0.3 | 0.5 | 0.3 |

| OANDA | 1.5 | 1.2 | 1.8 | 1.1 |

| Plus500 | 1.5 | 1.5 | – | – |

Non-trading fees at the best US forex brokerages

| Broker | Account fees | Inactivity fees | Withdrawal fees |

|---|---|---|---|

| IG | $0 | $/€14/£12 per month after two year of inactivity | Free for debit and credit cards, $15 for international bank transfer |

| TD Ameritrade | $0 | $0 | Free ACH withdrawal, but wire transfer cost $25 |

| FOREX.com | $0 | $/€/AUD 15, £12 or JPY 1500 per month after one year of inactivity | Free withdrawal, except for US, Canada |

| Interactive Brokers | $0 | $0 | One free per month, after that $10 |

| OANDA | $0 | $10 per month after one year of inactivity | No fees for credit cards, but bank transfer cost $20 |

| Plus500 | $0 | If you don’t use the platform for more than 3 months you’ll have to pay $10 a month. | No |

The Best CFD Brokers and Trading Platforms

CFD stands for “Contract for Difference.” It is a financial derivative that allows traders to speculate on the price movements of various financial instruments without actually owning the underlying asset. Instead, traders enter into a contract with a broker,.. READ MORE

What to consider when choosing a forex broker

For choosing a forex broker, you’ll need to focus on at least a few features that are common to any forex broker:

Pricing

For choosing a forex broker first you need to compare the pricing structure of different forex brokers. Generally, Forex brokers have two ways to price their services: by baking the price into the buy-sell spread or on a commission basis. Spreads are typically quoted in pips or one ten-thousandth of a point.

Leverage

Leverage is another aspect you may need to look at. Leverage offered by brokers that permits traders to borrow funds to magnify their potential profits or losses. Leverage in forex works by multiplying the trader’s initial investment, known as margin, to gain greater exposure to currency pairs.

The leverage ratio indicates the amount of borrowed funds the broker provides about the trader’s margin. This increased buying power can offer substantial gains opportunities but also entail higher risks.

For example, with leverage of 100:1, traders can control $100 in the market for every $1 of their capital. While leverage can boost profits, it also magnifies the risk of losses, necessitating careful risk management.

Currency pairs

The next very important factor you need to consider is how many currency pairs are offered by the broker, Major currency pairs are offered by all brokers. But how many more pairs (minors and exotics) does the broker offer? The most popular currencies include the U.S. dollar, the euro, the U.K. pound, the Japanese yen and the Swiss franc.

Spreads

Spread is another very important aspect you need to look at. the “spread” is the difference between the buy (bid) and sell (ask) prices of an asset. You need to look at How wide the broker’s spreads for trades. The higher the spread, the less appealing the transaction. Brokers who charge a spread markup will typically have wider spreads because that is how they are compensated.

Commissions

Some brokers add a commission to trades in addition to spreads. This is usually a flat fee per trade, although it can also be a proportion of overall trade volume.

Overnight or Swap Fees

If you hold a forex position open overnight, you might have to pay a fee, known as an overnight or swap fee. It is a fee that you pay or get based on the interest rate differential between the two currencies in the pair and whether you are long or short.

Inactivity Fees

Some brokers charge inactivity fees if you do not make a certain number of trades within a set timeframe.

Withdrawal Fees

Some brokers may charge you for withdrawing funds from your account. Before deciding for a broker, review the cost structure and withdrawal procedures.

Not every broker charges fees in the same way. Some charge a commission per trade, while others profit off the spread. Some may also include hidden fees, like as inactivity or withdrawal fees. Understanding these fee structures is critical for making educated comparisons.

What are the best trading platforms for U.S. Forex traders?

While choosing the best trading platforms, US traders need to consider these three key factors: User interface and functionality, technical tools, such as indicators and charting tools, and accessibility, including mobile trading apps.

MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is the world’s most popular forex trading platform for retail investors. Its strength rests in its user-friendly design and advanced mobile apps, which enable trading while on the road. Furthermore, MT4 is well-known for its Expert Advisors (EAs), which allow traders to automate their trading tactics successfully.

MetaTrader 5 (MT5)

With sophisticated indicators and better charting capabilities, MetaTrader 5 (MT5) advances technical analysis beyond its predecessor, MT4. This platform is intended for traders who require more detailed analysis and a wider selection of technical tools to inform their trading decisions. MT5’s advanced charting features make it a top choice for traders seeking extensive market research.

TradingView

TradingView stands out for its superior user interface and superb charting capabilities, making it an excellent alternative for traders looking for tools similar to those used by professional traders. Its user-friendly interface and excellent charting capabilities appeal to traders who value simplicity as well as thorough market analysis. This platform is especially useful for people who need detailed and accessible market insights to guide their trading methods.

What account types are available?

Here are some of the most popular account types offered by forex brokers in the United States:

- Standard Account: These are the most frequent types of accounts that forex brokers provide. In the United States, they provide access to the worldwide FX market and may also include spot commodities and cryptocurrencies. The minimum deposit for basic accounts varies widely amongst brokers.

- Premium Accounts: These accounts are intended for high-volume, professional traders. They provide cash rewards based on trading volume and may include other benefits such as a dedicated account manager.

- Demo Accounts: Almost all forex brokers provide demo accounts, allowing traders to test their methods with virtual funds before risking real money. This is an excellent method to familiarize yourself with the broker’s platform and put your trading talents to the test.

What is the available leverage?

Leverage enables traders to amplify their positions with borrowed cash, so expanding their trading potential beyond their account balance. The availability of leverage is a significant advantage in forex trading. In the United States, leverage in forex trading is regulated by the National Futures Association (NFA).

For spot forex trading, U.S. traders have access to a maximum leverage of 50:1. This means that with a $1,000 account balance, traders can control positions worth up to $50,000. However, in the case of forex futures, a higher leverage of over 400:1 is available.

What is the margin in forex trading?

When you trade forex, you are only required to put up a small amount of capital to open and maintain a new position. This capital is known as the margin.

In other words, Margin is simply a portion of your funds that your forex broker sets aside from your account balance to keep your trade open and to ensure that you can cover the potential loss of the trade. It enables traders to manage larger holdings with a smaller amount of capital.

For example, if you want to buy $10,000 worth of USD/EUR, you don’t need to put up the full amount, you only need to put up a portion, like $4,000. The exact amount depends on your forex broker or CFD provider.

The margin portion is “used” or “locked up” for the duration of the specific trade. After closing a trade, the margin is returned to your account and can be used to place additional trades.

Forex trading FAQs

What is forex trading?

Forex trading involves exchanging one currency for another. The one major practical reason for forex trading is to speculate and profit off of currency movements and other reasons includes such as traveling abroad. The most popular currencies include the U.S. dollar, the euro, the U.K. pound, the Japanese yen and the Swiss franc.

What do forex futures mean?

Forex futures are exchange-traded contracts that allow you to buy or sell a currency at a predetermined price and deliver it at a future date.

Is forex trading legal in the US?

Yes, forex trading is legal in the United States.

Is CFD trading legal in the US?

No, CFD trading is not permitted in the United States.

What is the risk of forex trading?

Forex trading involves many risks such as interest rate risk, risks due to leverage, country risk, and counterparty risk.

Is hedging allowed in the US?

No, the U.S. prohibits hedging in forex trading.

What are the leverage limits for U.S. Forex traders?

The NFA limits leverage available to retail spot forex traders in the United States to 1:50 on major currency pairs and 1:20 for others.

How do I know if my forex broker is regulated?

Your selected forex broker must be regulated by any regulator such as FCA because The Commodity Futures Trading Commission (CFTC) says that most scams involve unregistered people, products, or companies.

So if you’re engaging in forex trading, you’ll want to use a registered broker, and it’s easy to determine if you’re working with one.

- You may check if a forex broker is properly registered by visiting the National Futures Association website (which is overseen by the CFTC) and utilizing its search engine.

- You can also visit the official website of the Commodity Futures Trading Commission (CFTC) and search for the broker’s name or registration details in the CFTC’s database.

- If you have any issues or concerns about a broker’s regulatory status, you can contact the CFTC or the NFA immediately.

- You can verify a broker’s registration, disciplinary or regulatory history, and financial information.

Do you need to pay tax on forex trading in the US?

In the United States, forex trading is considered a commercial activity, and you must pay taxes on your gains.

Methodology

To choose the best US forex brokers, we thoroughly check, verify, and compare the elements that we consider to be the most important to consider when choosing an excellent broker. This includes the benefits, drawbacks, and overall grades determined by our research. Our goal is to help you find the ideal broker for your investor needs. You can read more about our methodology by visiting this page.